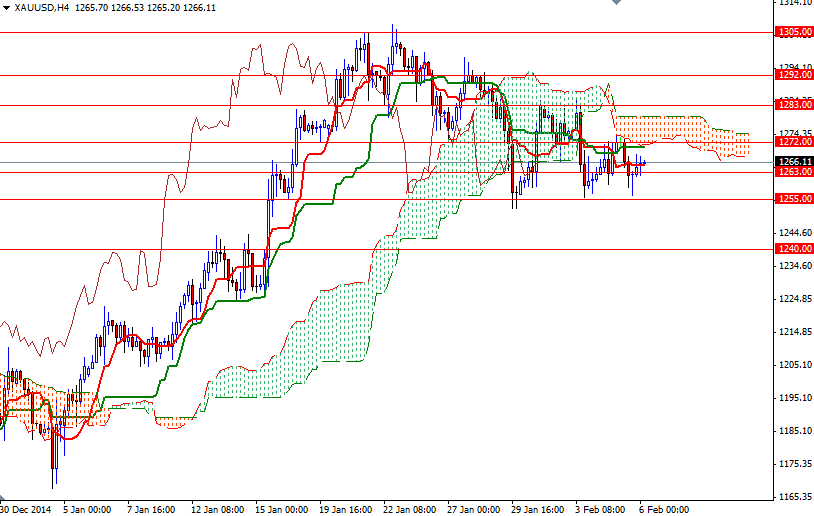

Gold prices settled lower on Thursday but remained within the trading range of the previous 5 trading days. The precious metal initially traded as high as $1273.83 an ounce but the Ichimoku clouds on the 4-hour time frame offered resistance and sent prices back below the $1263 level. As a result the market tested the support around the $1255 level before weaker than expected data from the U.S. put pressure on the greenback. The Labor Department said initial claims for state unemployment benefits rose by 11K to 278K. A separate report from the Commerce Department showed the trade deficit widened to $46.6 billion in December from a revised $39.8 billion in November.

Focus now turns to the U.S. jobs report which will be released later today. The Federal Reserve’s future plans depend on whether the labor market continues to improve - specifically, whether wages start to grow faster. Since the greenback’s strength and appetite for risky assets are gold’s biggest enemies, we will watch the data closely. It seems that the market will be spending some more time between the 1255 and 1272 levels until the announcement.

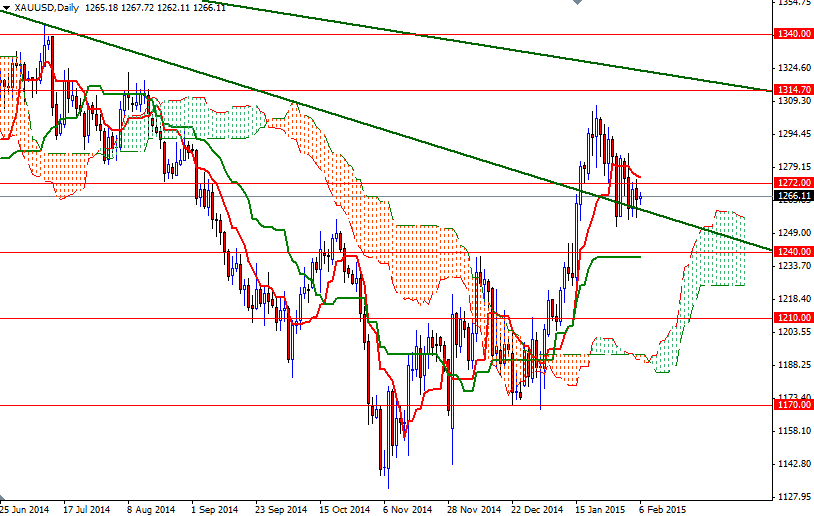

On both the weekly and daily charts, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) are positively aligned. However, the XAU/USD pair is trading below the Ichimoku cloud on the 4-hour time frame. In addition to that, the Chikou-span (closing price plotted 26 periods behind, brown line) is moving just below the cloud. As I have been saying recently, I think breaching the barrier around the 1283 level is essential for a bullish continuation towards 1292/5. Once above that, the market will probably be aiming for 1305/8. Breaking above the 1255/2 area would imply that the short-term technical outlook is shifting to the downside. In that case, 1246.80 and 1240 might be the next possible targets for the bears to capture.