Gold extended gains for a third session on Monday, supported by safe-haven bids as talks between Greece and euro zone finance ministers collapsed in disarray. The new Greek government, which vowed to reverse some of the austerity measures, rejected an EU offer to extend its current bailout. Greece’s finance minister, Yanis Varoufakis, said that Greece wouldn't accept prolonging the bailout for six months unless the creditors agreed to water down the austerity conditions attached to the deal.

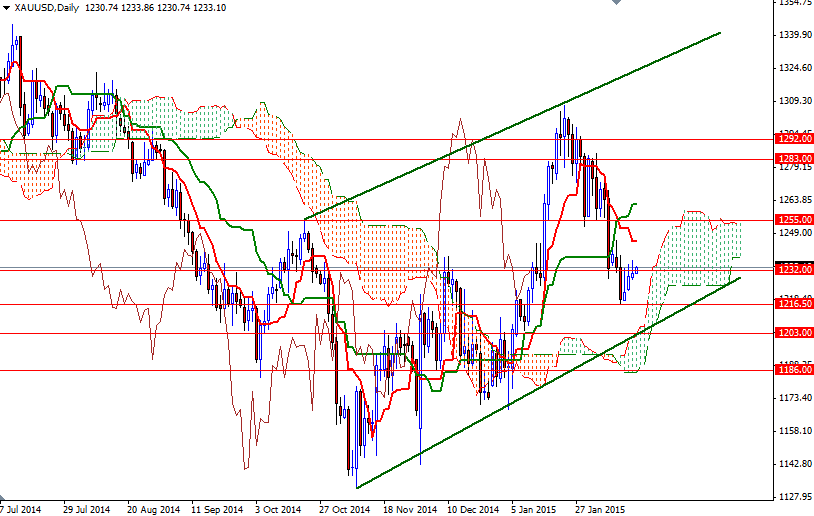

Although gold is supported by increasing concerns that Greece is edging closer to a chaotic exit from the single currency, the dollar continues to benefit from the optimism over US economic growth. Tightening trading range suggests that some investors shifted to the sidelines ahead of the Federal Open Market Committee's meeting minutes which will be released tomorrow. The XAU/USD pair is trying to hold above the 1232/3 area at the moment but lack of momentum and the fact that the market is trading below the Ichimoku could on the 4-hour time frame makes me a bit skeptical.

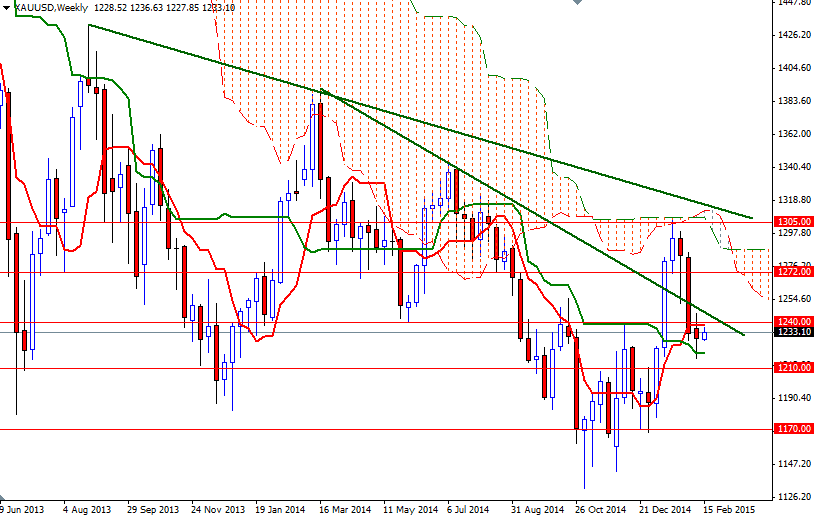

As you can see, both the Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-day moving average, green line) are flat. In other words, there is a possibility of visiting the 1203 - 1200 area (i.e. the daily cloud) if the XAU/USD falls through the 1216.50 support level. Initial support is located at the 1223 level. If the bulls are able to maintain control and clear the resistance at 1240, then it is likely that the market will test 1245 next. I think a close above the 1255 level is essential for a bullish continuation towards 1272.