Gold prices fell 1.13% yesterday, extending their losses to a second straight session, as a rally in equities sapped the precious metal's safe-haven appeal. Stock markets rallied around the world yesterday after Athens moved to end the impasse with creditors, calming fears that the standoff between Greece and the rest of the EU would erupt into a fresh crisis. In economic news on Tuesday, the Commerce Department reported that new orders for factory goods declined 3.4% in December.

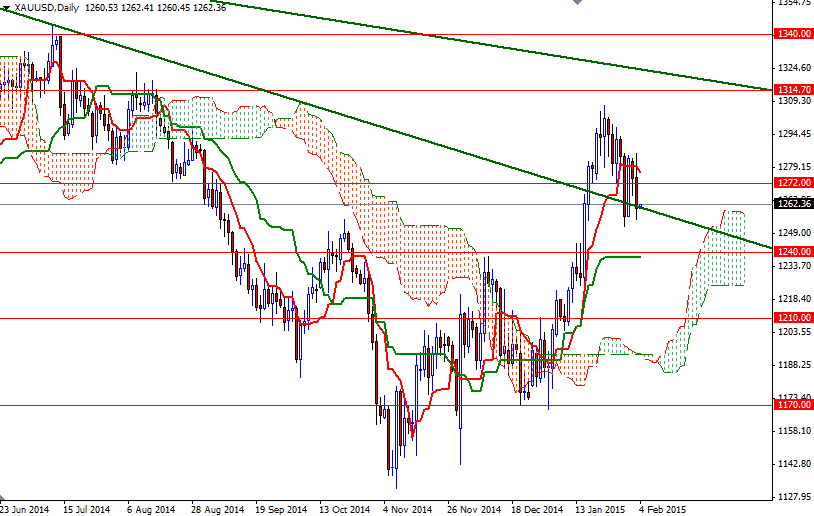

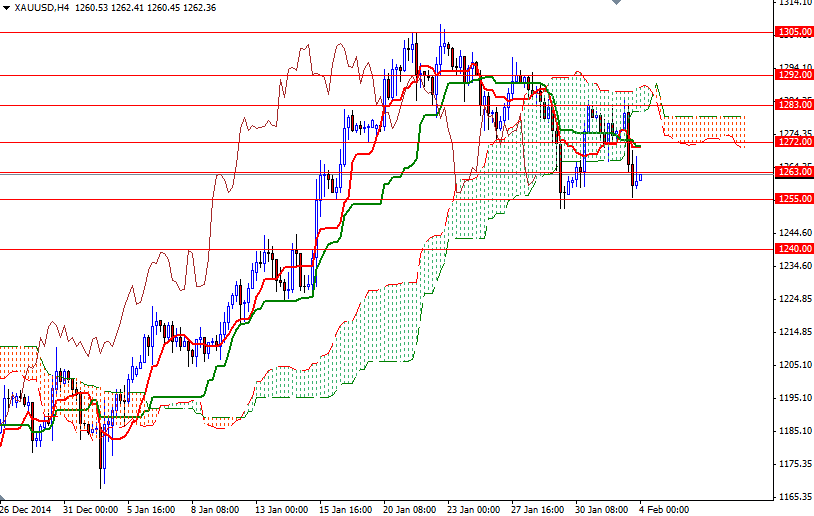

The XAU/USD pair initially tried to pass through the 1283 resistance level found enough resistance to reverse and drop below the 1263 level. As a result, the market tested the support at 1255. The pair gives us a mixed picture as prices remain different sides of the Ichimoku clouds on the daily and 4-hour charts. We have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross on the weekly and daily charts but in order to gain an upward momentum prices will have to climb above the 1292 level. On its way up, expect to see resistance at 1270.70/1272 and 1283.

To the downside, initial support is at 1255, followed by last week's low of 1252. If gold prices falls through 1252, we will probably see the market testing the 1240 level. Closing below this level would encourage sellers and increase the possibility of an attempt to visit the 1210 support. Market participants are likely to remain cautious ahead of the release of key economic data.