Gold prices climbed for a second day and settled at $1209.08 an ounce, gaining $4.93, on hopes that the Federal Reserve will not be in a hurry to hike rates. The market initially pair tried to pass through the 1219/22 resistance area but failed after stronger-than-expected U.S. data lifted the dollar. Figures released by the Commerce Department showed that demand for durable goods increased 2.8% in January.

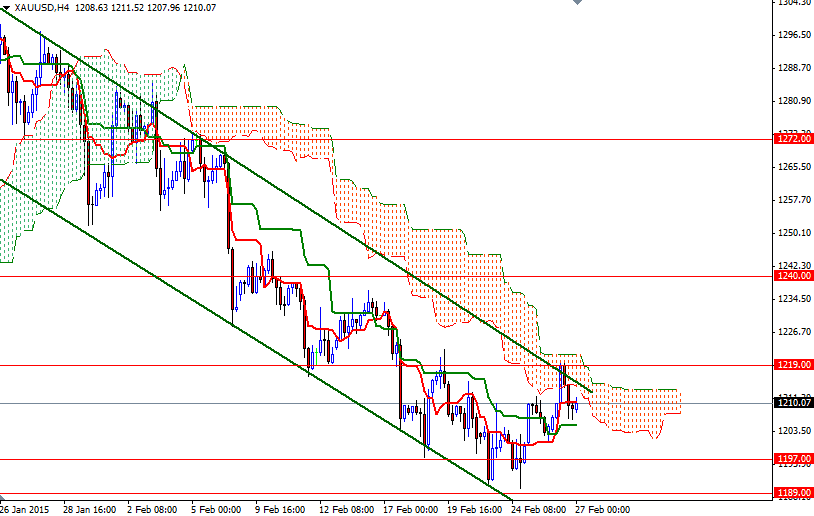

The dollar’s uptrend is likely to continue to provide a headwind for the market but despite the strength in the dollar, recently gold prices repeatedly found strong support between the 1200 and 1189 levels. As a result, we now have a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross on the 4-hour chart. On the other hand, until the market anchors above the cloud there won't be many reasons for medium traders to buy gold.

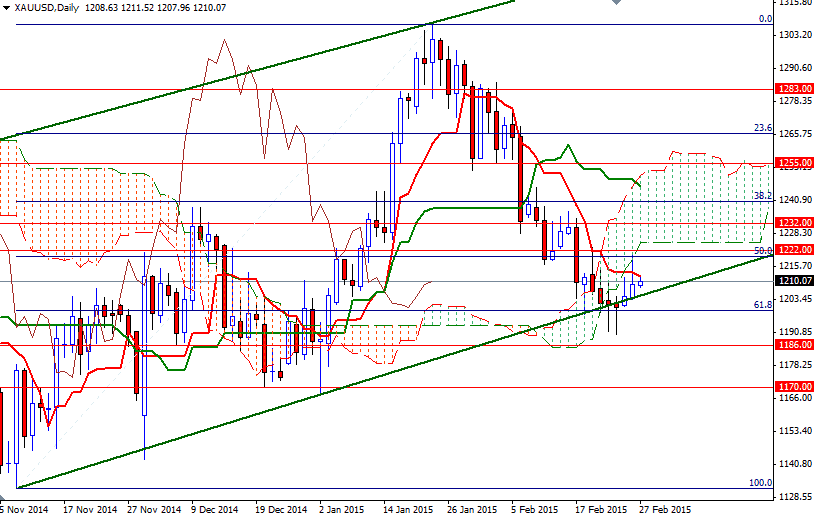

If the XAU/USD pair breaks out of the descending channel and stays above the cloud (4-hour chart), then the short term outlook would change. In other words, climbing above the 1222/19 area brings the possibility of testing the 1232 level. A daily close beyond that would make me think the bulls are aiming for 1240 next. However, keep in mind that the Ichimoku cloud on the daily chart indicates an area of strong resistance and because of that I think the market will encounter significant pressure there. To the downside, initial support is at 1203. If the bears increase pressure and drag prices below 1203, it is likely that the market will test 1199/7. They will have to shatter this support if they intent to charge towards the 1189/6 area.