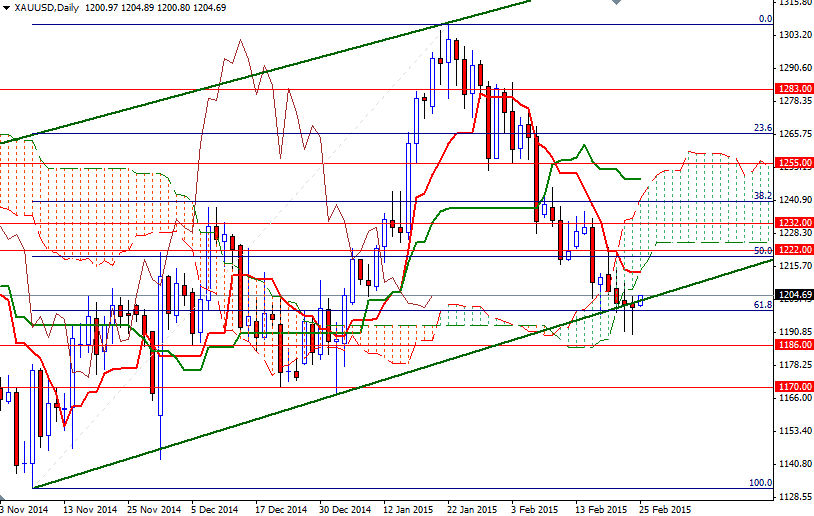

Gold prices initially fell on Tuesday but the market found enough support just above the $1189/6 area and formed a hammer. Gold rebounded from the lowest level in seven weeks as Federal Reserve Chair Janet Yellen's comments prompted the market to push back the expected timing of an interest rate hike. Although Yellen suggested higher rates were not on the immediate horizon, she signaled that the central bank might eliminate the word “patient” from the forward guidance in its policy statement.

Now, most investors expect the Fed to raise interest rates in October but it appears they may pull the trigger in June (or September) if the committee members become reasonably confident that inflation is rising. Anyway, as we often say its not the news, but the market reaction to news that matters. The recent price action indicates that the bulls are trying to hold prices above the 1189/6 region.

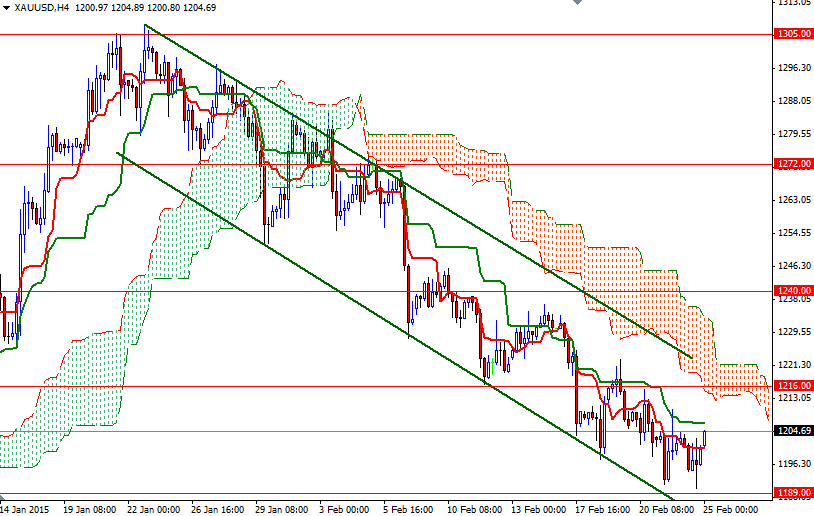

If the market stays above the 1199/7 area, where the Tenkan-sen (nine-period moving average, red line) on the 4-hour time frame and the 61.8 retracement of the bullish run from 1131.96 to 1307.47 coincide, it is possible to see prices heading towards the clouds. In that case, resistance can be found in the 1213.45 - 1216 area. The bulls have to penetrate this barrier so that they can test the 1222/3 resistance. However, a failure to hold prices above 1999/7 could bring sellers back to the market and drag us back to the support at 1189/6. If this support gives way, 1170/66 and 1159 will be the next possible targets for the bears to capture.