Gold prices advanced on Wednesday, marking the first rise in three days, with the metal’s attractiveness as a safe-haven asset in the wake of the European Central Bank's decision to tightens the screw on Greece offsetting pressure from strength in the dollar. Yesterday, the ECB surprised markets by announcing it will no longer accept Greek bonds as collateral for its liquidity operations. It appears that any sign of trouble in the Eurozone will lift demand for gold but market players are likely to move cautiously before the U.S. government's jobs report. Private payrolls climbed 213K in January, less than expectation of 224K, according to ADP Research Institute figures released yesterday

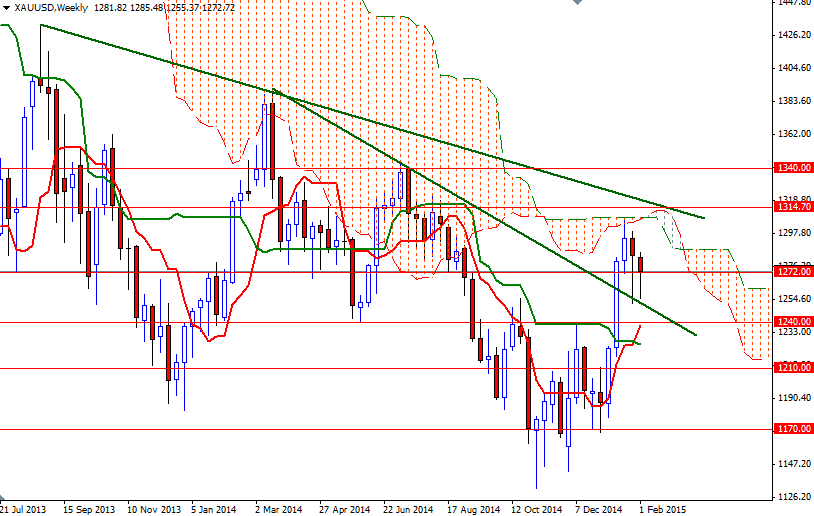

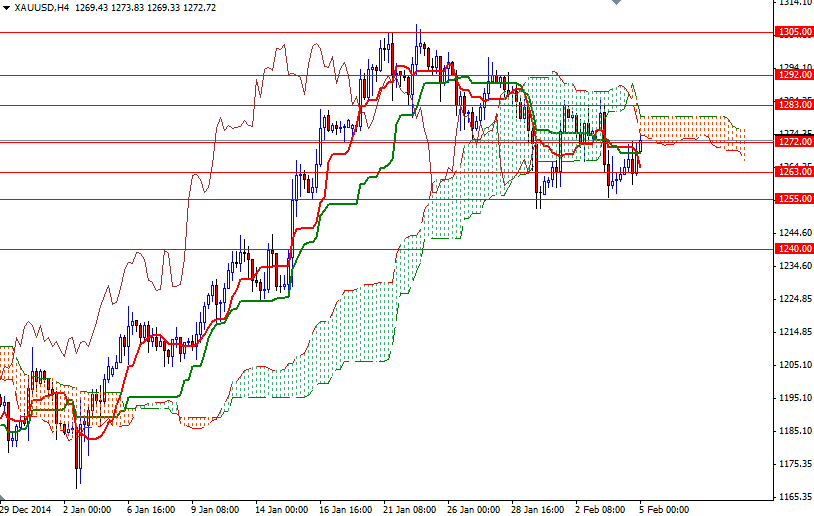

Technical buying was also behind gold's 1% rise. As you can see from the charts, recently the bulls have been trying to protect their ground around the 1255 level and the bears are increasing pressure each time the market approaches the 1283 level. I think the market will go back and forth until we leave this area completely. In order to regain their strength and march towards the 1292/5 area, the bulls will have to push the pair above 1283. A daily close above 1295 would make me think that the market is ready to challenge the 1305/8 resistance.

However, if the Ichimoku clouds on the 4-hour time frame continues to offer resistance and prices starts to fall, we might pull back to the 1263 level. The bears will have to drag prices below this level so that they can force the market to retest the 1255/2 area A break below the January 29 low of 1252 could puts us back on track with such a scenario eying subsequent targets at 1246.80 and 1240.