Gold prices ended Friday's session down 2.56%, or $32.39, to settle at $1232.79 an ounce as another solid U.S. payroll reading, coupled with strong growth in wages, stoked bets the U.S. central bank will increase interest rates by mid-year. The American dollar gained strength across the board after the Labor Department reported that the economy added 257K jobs in January, surpassing consensus estimates of 236K, and average hourly wages jumped 0.5%. Data also showed that gains for the prior two months were revised up by a total 147K.

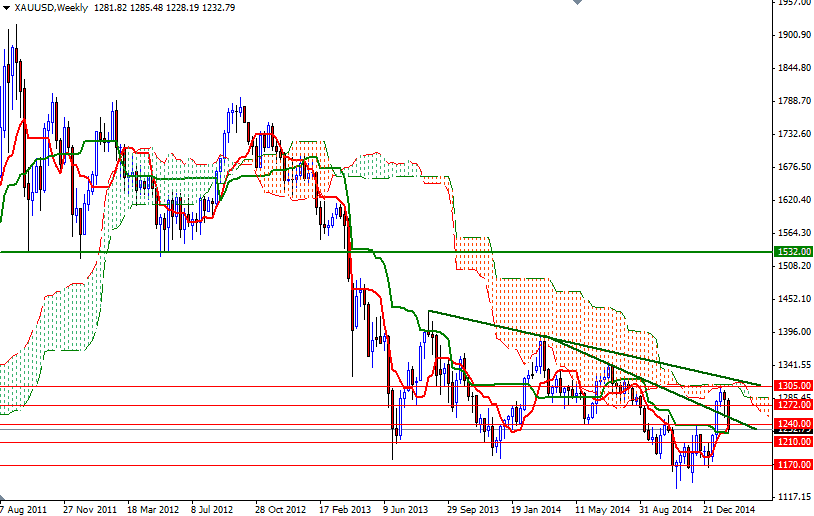

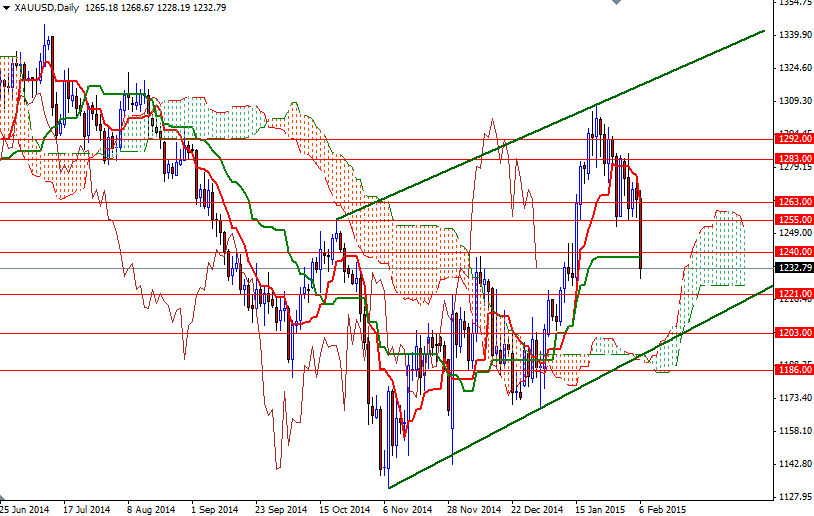

The XAU/USD pair accelerated its slide and hit the lowest level since mid-January after the support around the 1255/2 region was shattered. Although prices recovered slightly to 1232.79, closing below the 1240 support level is negative for gold. From a purely technical point of view, the odds favor further downside as long as the XAU/USD pair remains below the 1255/63 area. To the downside, initial support is at 1225, followed by 1221. The bears have to drag prices below the 1221 level so that they gather enough strength to challenge the bulls at 1210. Once below that, the market will be aiming for the daily Ichimoku cloud.

In order to ease downward pressure the market has to climb above the Ichimoku cloud on the 4-hour time frame. To the upside there will be hurdles such as 1240, 1255/2 and 1263. Keep in mind that the Ichimoku clouds define an area of support or resistance depending on their location and in our case the weekly cloud represents resistance and daily cloud represents support. While the long term trend is rather bearish in the big picture, prices may struggle to hold onto gains. That said, I expect the near-term trading range to be roughly between 1255 and 1210.