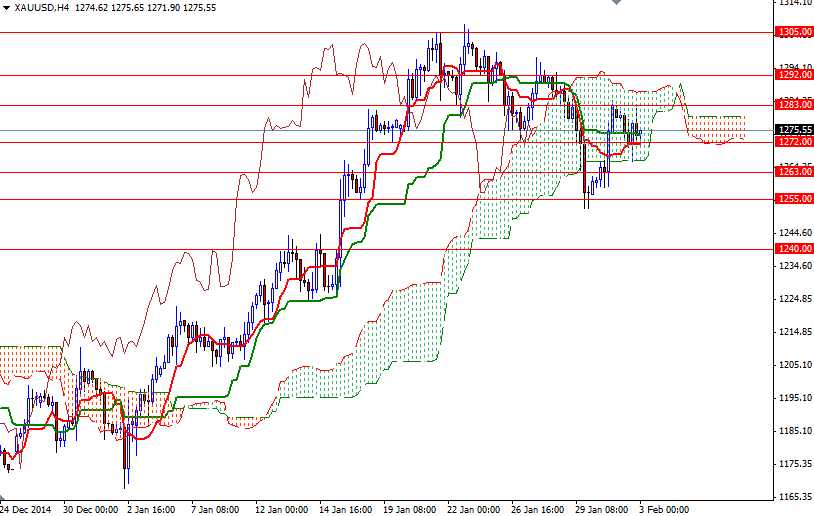

Gold prices closed lower on the first trading day of the week after a 2.1% rally on Friday, but losses were modest in the wake of worse than anticipated U.S. data. The market bounced off the bottom of the Ichimoku cloud on the 4-hour chart after the Institute for Supply Management said its index of national manufacturing activity declined to 53.5 in January from 55.1 in December and the Commerce Department reported consumer spending fell 0.3% in December.

Looking ahead, the market awaits a flurry of economic data due out this week but of course the highlight of the week will come on Friday when the Labor Department releases its employment report for January. The potency of the first rate hike could be increased or diminished, depending on incoming data. In the meantime, I will be monitoring the developments in Greece as the new government tries to persuade its international creditors to accept a new debt agreement.

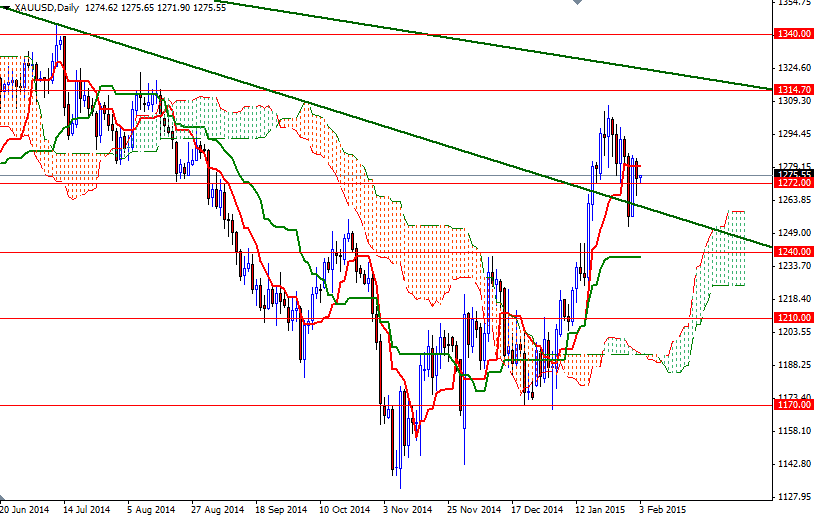

Currently the XAU/USD pair is trading within the borders of the Ichimoku cloud on the 4-hour time frame (the market is above the cloud on the daily chart but still below the cloud on the weekly time frame) Basically, the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. So speaking strictly based on the charts, the XAU/USD pair has to push its way through the 1292 resistance level in order to revisit the 1305/8 area which blocked the bulls' way last month. Closing above 1305/8 is essential for a bullish continuation towards 1314.70 - 1316.65. To the downside, I will be keeping an eye on the 1266.70 - 1263 area. If that support gives way, I think the market will test the 1255 level. The bears will need to hold prices below 1255 so that they can have a chance to start a journey to the 1240 level.