Gold prices dropped 0.52% over the course of the week as the conditions in the marketplace continued to diminish desire for safe-haven diversification. The market traded as low as $1216.57 on hopes Greece will reach a compromise with its European partners but prices found some support after disappointing U.S. data weakened the greenback. Gold's third weekly drop in a row suggest that investors aren't too concerned about the Greek crisis yet. However, how long it will take to find a common solution is unclear and without financial support from the "Troika" of international lenders (the European Union, European Central Bank and International Monetary Fund) Greece could run out of funds as soon as next month.

Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 155274 contracts, from 185015 a week earlier. I think the primary driver of gold prices in coming days will be the performance of equities markets and dollar. On the other hand, the Federal Reserve's plans to hike rates sometime this year will be the long-term driver of gold.

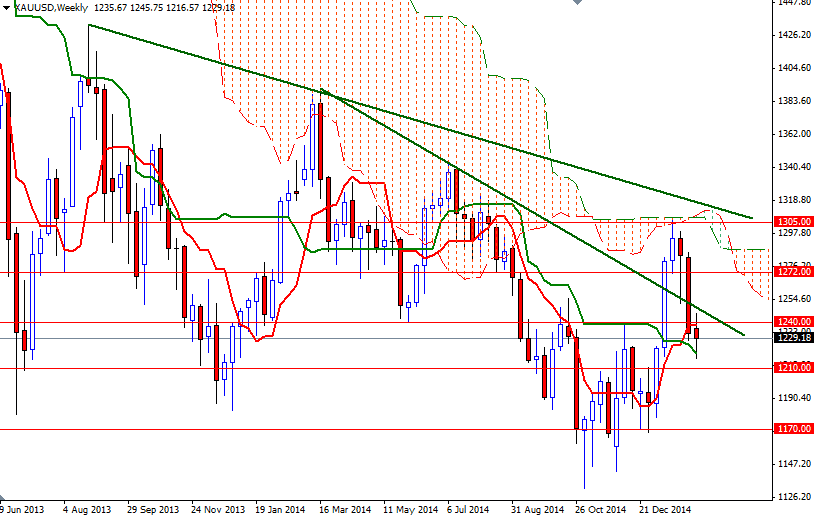

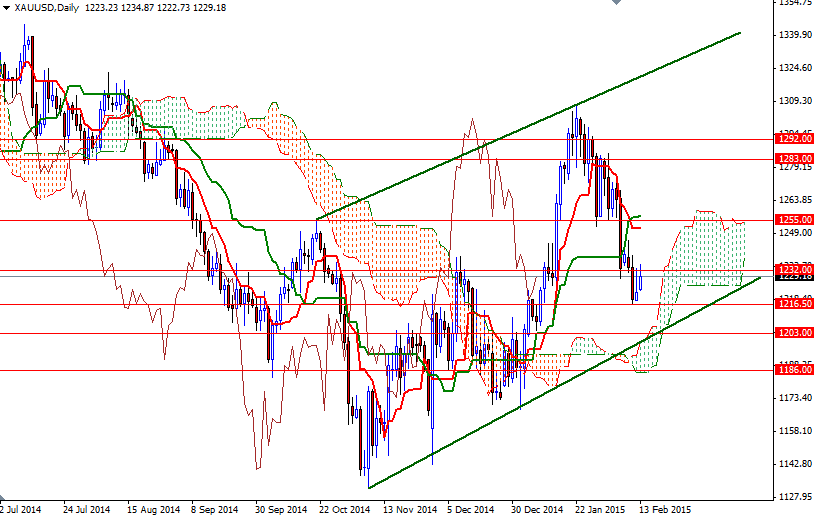

From a technical perspective, I think the week ahead will play an important role. The market will either break above the 1255 and head towards the Ichimoku cloud on the weekly time frame or drop below the 1200 level and head back to the 1180/70 area. In the near term, I will be paying attention to the 1216.50 and 1232/3 levels. If the bulls manage to climb and hold prices above 1232/3, there is a chance we will see the market testing the 1244/0 area. Beyond that, the bears will be waiting at 1255. Falling through 1216.50 would indicate that the XAU/USD pair is getting ready to challenge the support at 1210.