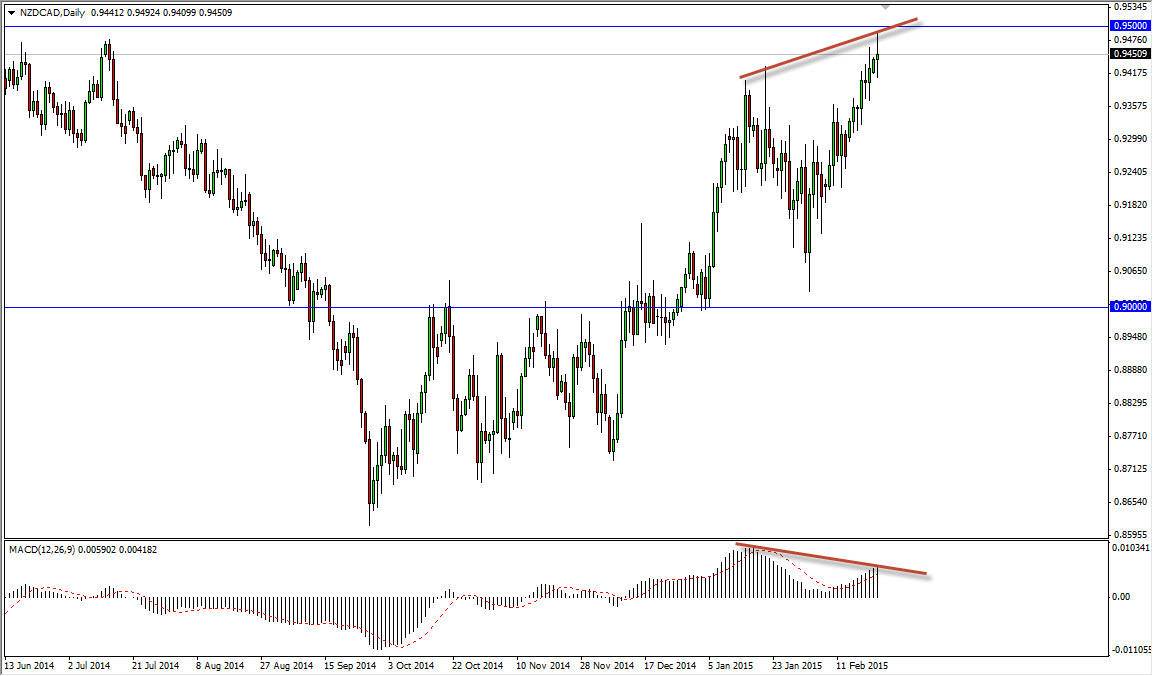

The NZD/CAD pair broke higher during the course of the day on Monday, testing the 0.95 resistance barrier. The resulting candle is a shooting star that shows significant weakness. However, what has really caught my attention is the fact that the MACD histogram is lower at this high that was the previous one. In other words, it appears that we are running out of momentum at extreme highs. This is an area of significant resistance on the longer-term charts, so that of course has caught my attention as well.

If we can break below the bottom of the shooting star, it’s very likely that this pair will drop somewhat significantly. It makes sense as well, considering that the New Zealand dollar has been one of the weaker currencies recently, and the Canadian dollar while struggling against the US dollar, has been holding its own against quite a few other currencies around the world.

Short-term trade

A lot of times when you go against the trend with a divergence set up like this, it can be very choppy. Because of this, I am only looking for short-term move lower and recognize that there will be a lot of volatility. Any bounce below will more than likely shake off a lot of the sellers, and that’s where confidence can leave the downside. If that’s the case, you could get significant bounces from time to time even if we do break down to the 0.90 level which I suspect could be possible.

This is a quick “smash and grab” type of trade, as I think this market is a bit overextended, and I don’t trust the New Zealand dollar in general because of the fact that the Royal Bank of New Zealand intervened and sold off the Kiwi dollar recently. I don’t think a lot of other traders trust this currency as well, so it’s a relative value play. That’s not to say it will go higher, I think it might eventually but I recognize that there is real dangerous territory ahead. On the other hand, if we broke above the 0.95 level on a daily close, I would have to assume that we go higher.