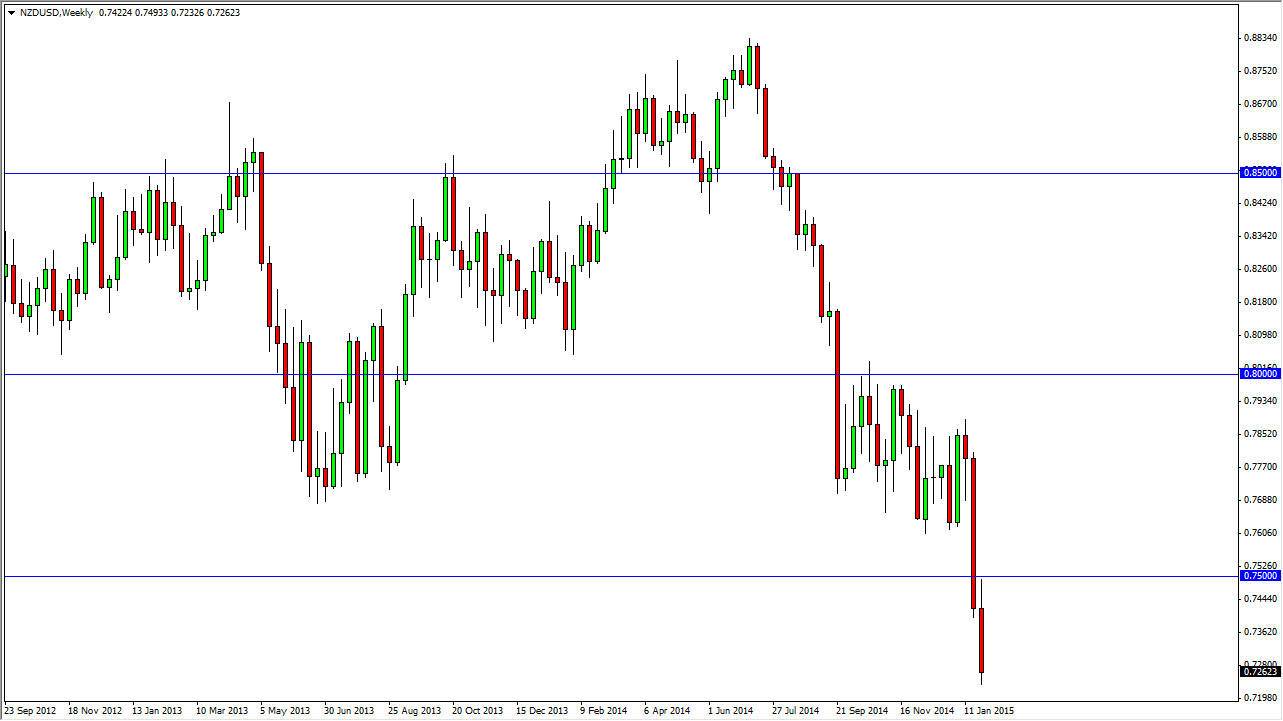

The NZD/USD pair recently has broken below the 0.75 handle, and as a result looks as if it’s ready to continue falling. You have to keep in mind that the Royal Bank of New Zealand has recently even gone so far as to intervene in this pair, to drive down the value of the Kiwi dollar. They believe that “fair value” is at the 0.68 handle. Because of this, I believe that the markets will continue to press this pair lower.

Further compounding the problems for the New Zealand dollar is the fact that the Royal Bank of New Zealand has suggested that rate cuts are necessarily out of the question, and that of course will drive down the value in the minds of traders. Balance that with the fact that the US dollar is the strongest currency in the Forex world, and as a result it appears that we have a little bit of a perfect storm at this point.

Continued bearishness

I believe that we will see bearishness of the New Zealand dollar until we had at least the 0.70 level. I will look to rallies as selling opportunities, and I believe that we could even reach the 0.68 level by the end of the month of February. Quite frankly, this pair tends to move massively in one direction or the other on impulsive candles, and that would not surprise me to see that yet again. With that, I believe that the pair cannot be bought as the New Zealand dollar continues to be a currency that will have too many forces working against it.

On top of all the central bank concerns, you have to think that the commodity markets are soft for a reason. Because of that, the market should have very little to celebrate when it comes to New Zealand, and with that I think we have a little bit of a one-way trade going for the month of February. I will be selling and selling again during the next several weeks