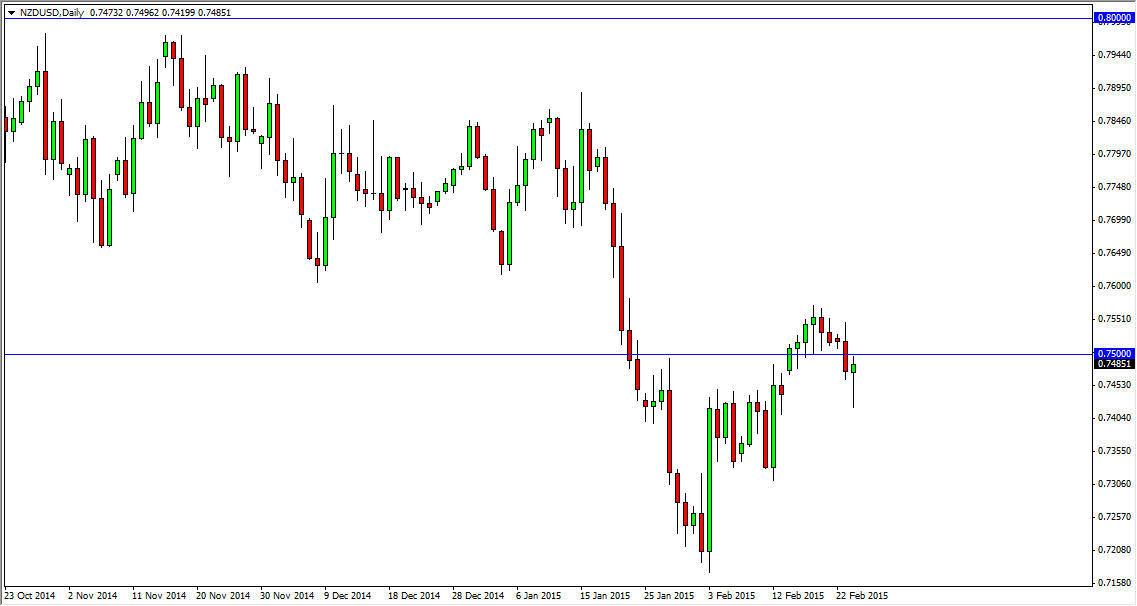

The NZD/USD pair initially fell on Tuesday, but found enough support near the 0.74 handle to turn things back around and bounce to form a nice-looking hammer. That being the case, the hammer is just below the 0.75 level, and if we can get above there I think that the market probably goes higher. The 0.7650 level above is resistance as it was once supportive from the consolidative area during late 2014, so I believe that this market is setting up for a nice short-term buying opportunity.

That being said, keep in mind that the New Zealand dollar is very sensitive to the commodity markets and the overall attitude of them. With that being the case, I think that we could get a little bit of a relief rally in both the New Zealand dollar and the commodity markets, we are still very much in a downtrend involved.

Royal Bank of New Zealand

I believe that the Royal Bank of New Zealand should continue to jawbone down the value of the Kiwi dollar, as they have done in the past. On top of that, the even entered the Forex markets and sold the currency, so traders will be a bit cautious on holding this particular currency. On top of that, do not forget that the Royal Bank of New Zealand even stated that they believe that “fair value” in this particular market is at the 0.68 level. I think that eventually we will see a move towards that level, but it won’t happen in one move obviously.

I think that there is a short-term buying opportunity, but quite frankly the easier to trade is to the downside. If we break the bottom of the hammer, we would more than likely find enough sellers to push this market down to the 0.73 level at the very least, if not the 0.7150 handle. I would love to sell a candle at the 0.7650 region that shows significant weakness as I would be willing to hang onto that trade.