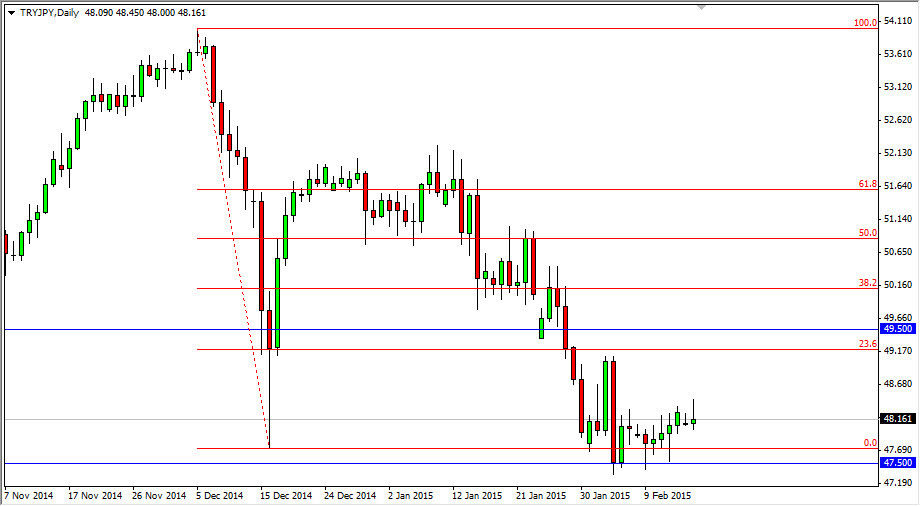

The TRY/JPY try to rally during the course of the session on Monday, but as you can see struggled and turned back around to form a shooting star. The Turkish lira is considered to be a “risk currency”, and as a result it’s very likely that this pair will fall every time there is a bit of fear in the marketplace out there, as it is a nice proxy for the emerging markets out there. With that I am looking at this as a potential basing pattern, but I think short-term we should continue a bit lower. The 47.50 level below should continue to be supportive though, so really I need to see this market make up its mind.

I’m pain attention to the world stock markets in order to make a decision in this pair as well, as if the Nikkei, the DAX, the CAC, and several other markets around the world tend to move in the same direction, this market should continue to go in the same direction as those. Because of that, the market should be one that is relatively easy to trade as long as we get some type of movement overall in the world’s financial markets.

The 61.8% Fibonacci retracement level

In early January, we tested the 61.8% Fibonacci retracement level from the massive selloff, we have now sold off from there. If we can crack below the recent low, we should continue to go much lower than that, as the Turkish lira will be a currency that a lot of people will shine at this moment. On top of that, there’s a lot of tension surrounding Turkey in general, so the lira of course will have to deal with such things as the fighting in Syria and Iraq.

Ultimately, I believe that rallies will be sold, and it’s not until we get above the 49.50 level that the buyers will have taken control again in my opinion. At that point time, anything’s possible but I really doubt that we are going to see that.