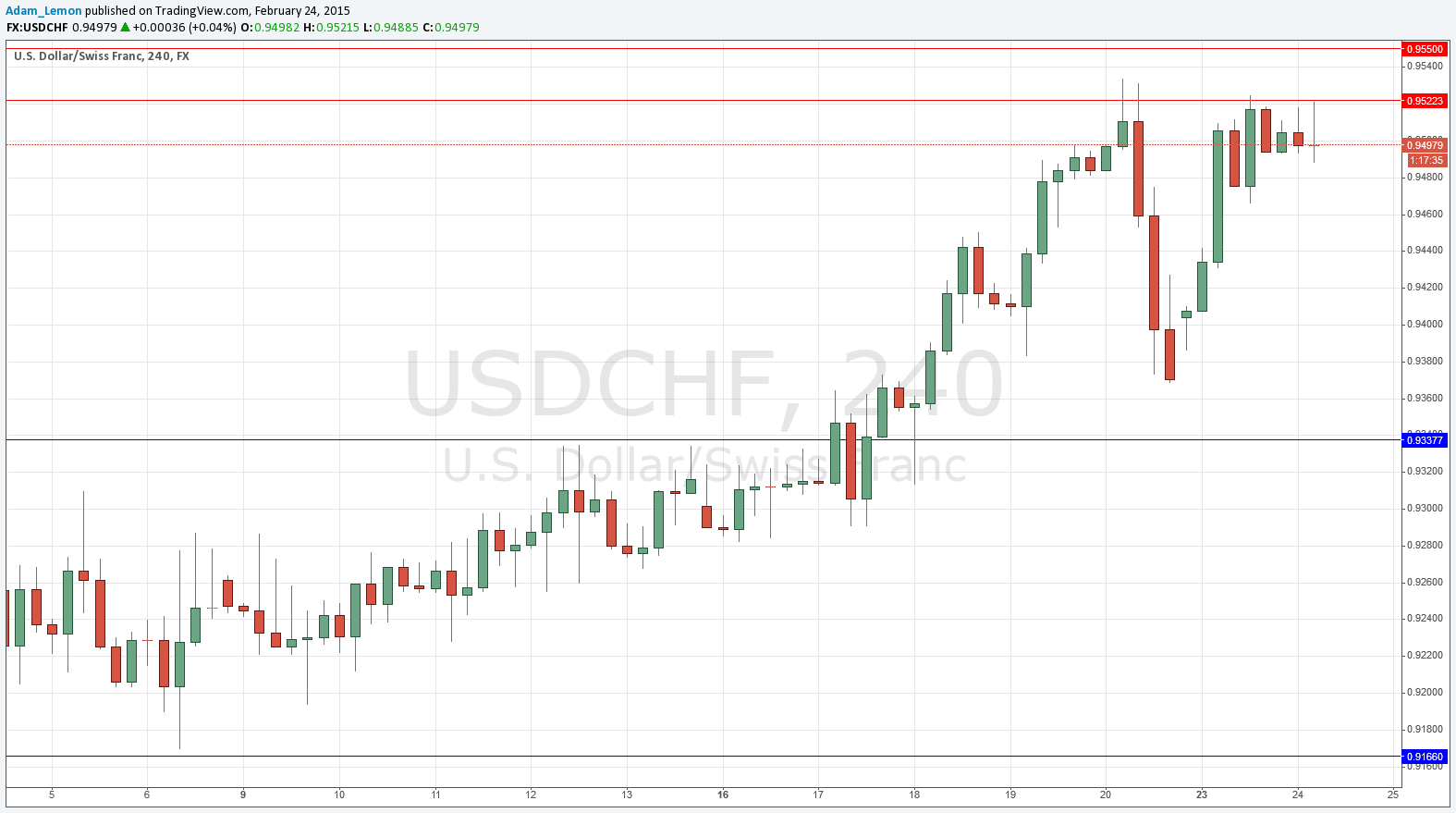

USD/CHF Signal Update

Yesterday’s signals were not triggered as although the price did reach 0.9522, it only happened after the London close and so was not a valid entry.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be entered between 8am and 5pm London time today.

Long Trade 1

• Go long after bullish price action on the H1 time frame immediately following the next touch of 0.9338.

• Place the stop loss 1 pip below the local swing low.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

As anticipated yesterday, the level at 0.9522 acted as strong resistance almost to the pip. However it is being tested again now just after the London open and so I am less confident it will hold, therefore I am not looking to go short here now. A breakout above this level should see a rise to 0.9550, a previous key weekly swing low which should provide firmer resistance.

Below, the previous resistance at 0.9338 is an obvious area for the price to reverse long at.

There are no high-impact events scheduled for the CHF today. Regarding the USD, at 3pm London time there will be a release of U.S. CB Consumer Confidence data and the Chair of the Federal Reserve will begin her testimony.