USD/JPY Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Short Trade 1

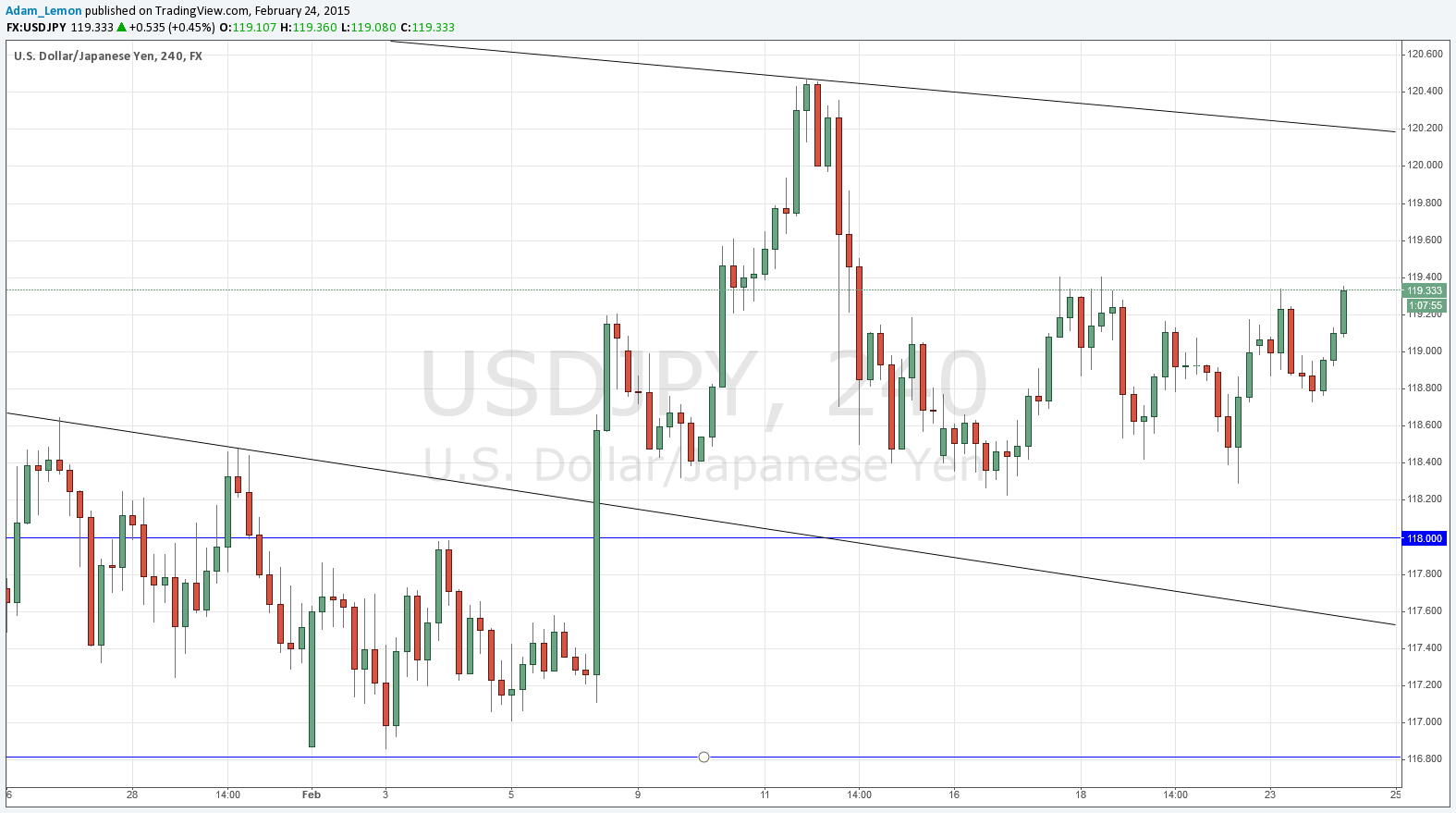

• Short entry following some bearish price action on the H1 time frame immediately upon the first test of the long-term bearish trend line currently sitting at around 120.20.

• Place the stop loss 1 pip above the local swing high.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

• Long entry following some bullish price action on the H1 time frame immediately upon the first retest of the broken trend line which is currently sitting at about 117.50 and/or the level at 118.00 itself.

• Place the stop loss 1 pip below the local swing low.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

The pair is slowly drifting up, but there has been no substantive change to the technical picture. The market is awaiting the Fed Chair’s remarks that will be given later today and tomorrow to help give more direction to the USD and the short-term move is likely to hinge on that.

There are no high-impact events scheduled for the JPY today. Regarding the USD, at 3pm London time there will be a release of U.S. CB Consumer Confidence data and the Chair of the Federal Reserve will begin her testimony.