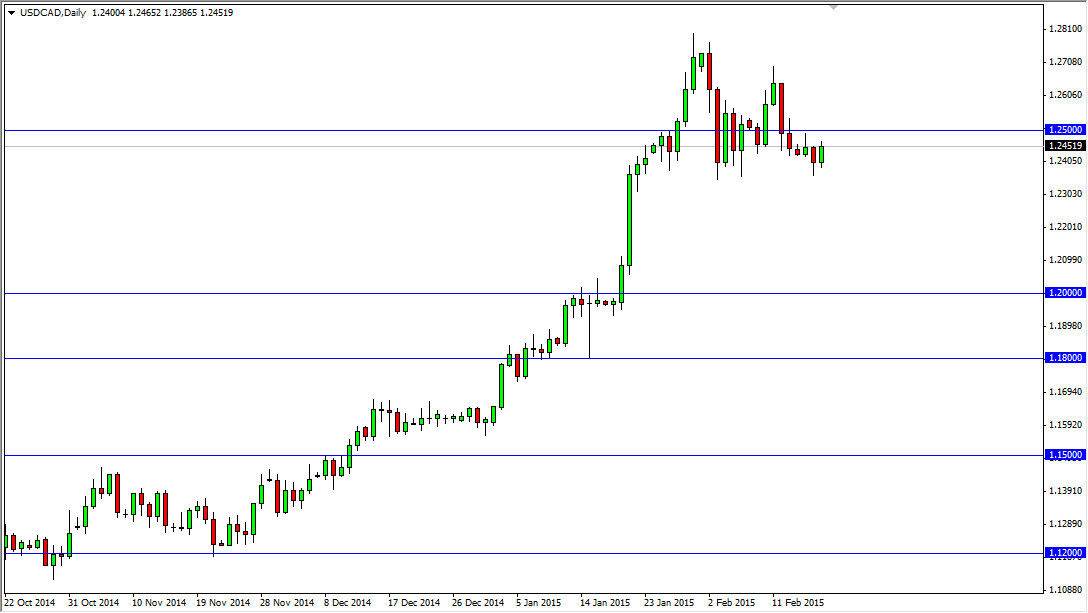

The USD/CAD pair bounced off of the 1.24 level during the session on Wednesday, continuing the consolidation area that we have been in for some time, and as a result I would fully anticipate that the market should go to the 1.25 level, and then possibly above there given enough time. This would be a continuation of will we have seen for some time now, and as a result I would start buying above that 1.25 handle.

However, if we break down below the 1.24 level I believe that we will then head down to the 1.20 level. With that, I wouldn’t be a seller because I believe that there would be more than enough support down there to keep the market afloat. I would look at it as an opportunity to pick up value in the US dollar as the Canadian dollar certainly will not outperform the greenback over the longer term.

Watch the oil markets

I think you should continue to watch the oil markets, as they of course have a pretty decent influence on the Canadian dollar. Ultimately, I believe that the US dollar will continue to climb against the Canadian dollar based not only upon a softer than expected oil market, but also a surprise interest-rate cut from the Bank of Canada. That of course is bad for a currency, so I don’t think that the Canadian dollar will appreciate anytime soon. With that, I think that we will continue to see a lot of choppiness but quite frankly if we do pullback I look at it as a great opportunity. In fact, I believe that the support that starts at the 1.20 level extends all the way down to the 1.18 handle, and it is not until we get below there that I can even fathom selling this currency pair.

That being said, I do not anticipate seeing that anytime soon, and as a result there’s absolutely no way that I am even looking for a selling opportunity anytime soon.