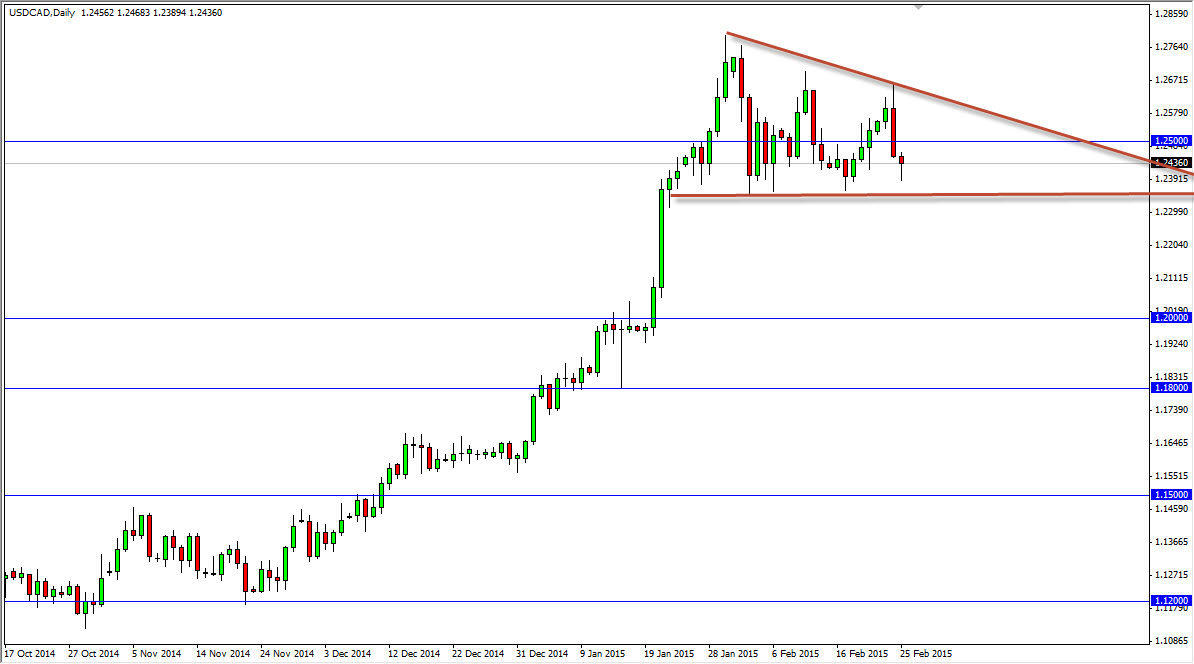

The USD/CAD pair fell initially during the session on Wednesday, but as you can see found support below the 1.24 level yet again, so having said that it looks as if the hammer that was formed during the day just simply suggests that the consolidation should continue. The market looks as if it’s trying to form some type of ascending triangle, but at the end of the day I still believe that this market is positive overall. Because of this, I think there might be a short-term pullback waiting to happen, but I am also still of the mind that we should test the 1.30 handle given enough time.

The 1.25 level is a bit of a magnet for price, and as a result a break above the top of the hammer sends the market looking for at least the 1.25 level, and then the downtrend line from the potential descending triangle. If we can break above that downtrend line, then I think we will ultimately head to the 1.30 level over the longer term. I still think we head there even if we pullback though, allow me to explain.

Oil markets

I believe that the oil markets will continue to be soft over the longer term, but they could get a little bit of a relief rally in the meantime. If they do, it makes sense that the USD/CAD pair would fall. However, I think that the 1.20 level below is massively supportive, and as a result I’m looking to buy supportive candles near there if we do break down. Because of this, I’m not interested in selling this market at all because the US dollar is without a doubt the favored currency in the Forex market right now.

As the oil markets look a bit terminal at the moment, I think longer-term the Canadian dollar will continue to be a bit soft as the oil markets and the recent rate cut by the Bank of Canada should continue to work against the value of the CAD. For me, this is a “buy only” type of market.