USD/CAD Signal Update

There are no outstanding signals.

USD/CAD Analysis

This pair usually tends to range: historical data over the past decade shows there is usually little predictability in its movements over long time intervals. This is usually explained by the fact that the economies of Canada and the U.S.A. are heavily intertwined and convergent, which tends to keep an exchange rate stable.

However the CAD is also a “commodity currency” as Canada is a big oil producer, so the value of the USD/CAD is quite highly positively correlated with the price of Oil in USD terms.

Over recent months, this pair has actually been trending strongly, with the CAD decreasing steadily in value since 2011/12 by more than 25% against the USD. The trend has been particularly strong in recent weeks, but has been falling off over recent days. Trend traders are waiting to see whether the strongly bullish USD trend that has dominated the Forex market since the summer of 2014 is going resume.

To some extent this will be driven by fundamental factors, and the fundamental factors remain in place for the time being. The USD has the tightest monetary policy expected by the market and the CAD one of the weakest, confirmed by its recent rate cut. However it seems that the price of Oil may be beginning to recover as it now trades above $50 per barrel, which would indicate a possible strengthening of the CAD.

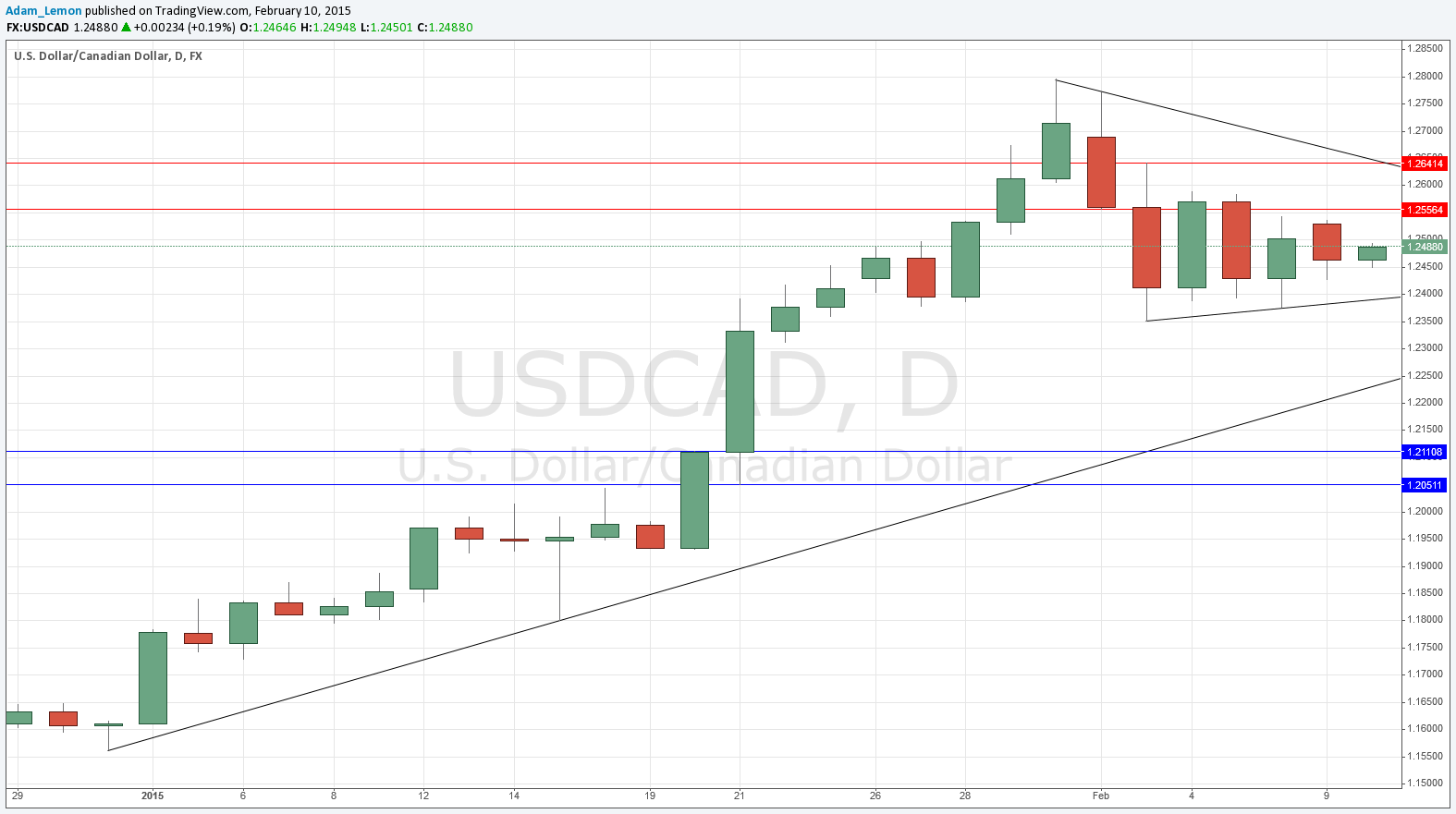

Aside from these issues, it is a question of price and technical analysis. Looking at the daily chart below, we can see that the price has been forming a consolidating triangle within a strong upwards trend:

We have an inner trend line connecting the lows of recent days. If this trend line is broken, the price is likely to fall to the lower, long-term bullish trend line. If that trend line is broken in turn, the price is likely to find some support in the demand zone drawn by the blue lines between 1.2110 and 1.2050.

There is strong resistance above provided by the confluence of a supply zone extending from 1.2556 to 1.2641, the higher of which levels is currently confluent with the bearish trend line. The price needs to make a convincing break above this level before we can expect to see any strong rise continuing.