USD/CAD Signal Update

There are no outstanding signals.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

Long Trade 1

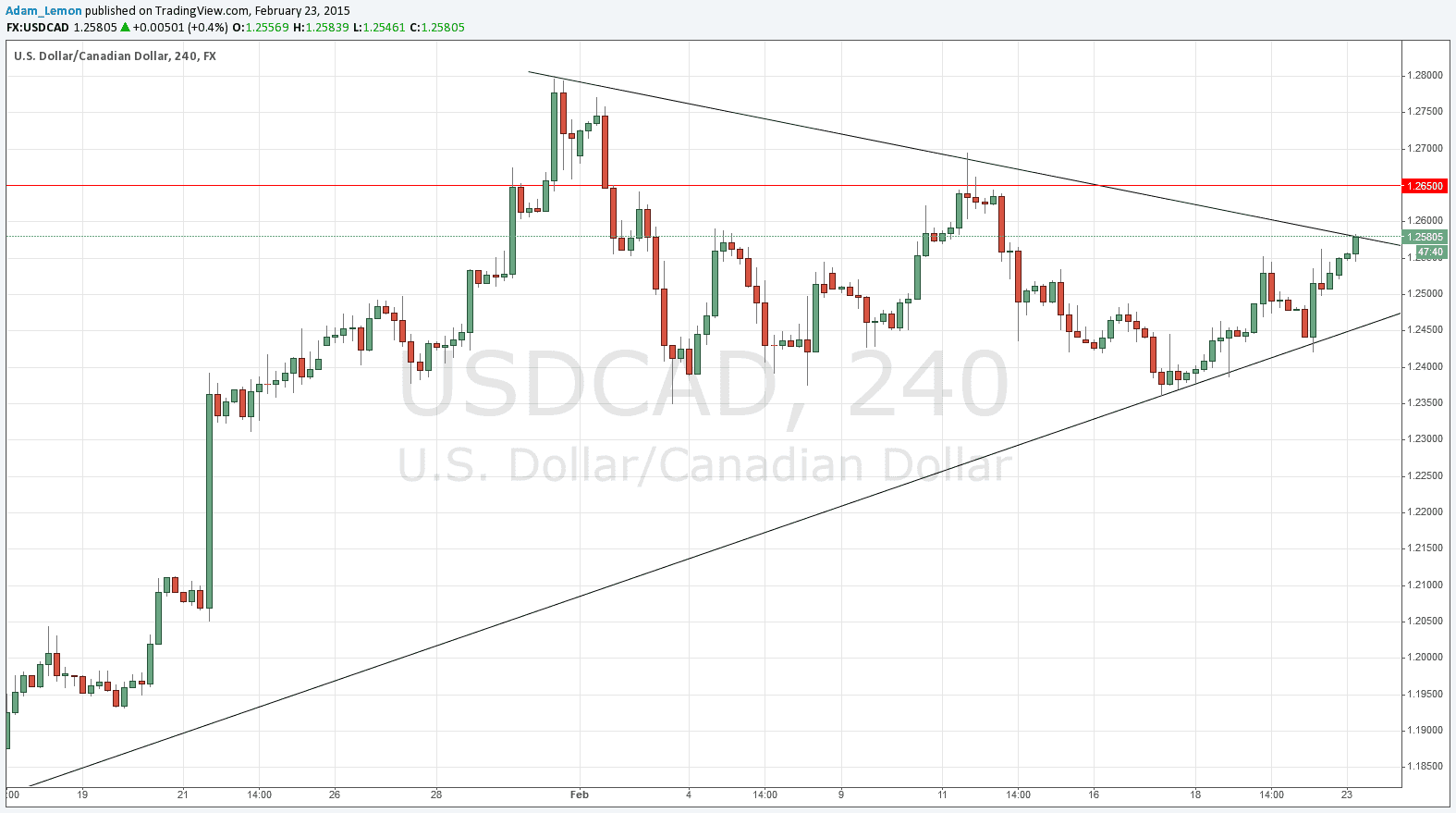

Long entry after bullish price action on the H1 time frame immediately following the next touch of the bullish trend line at around 1.2457.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.2650.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run

USD/CAD Analysis

In last week’s forecast I forecasted that the pair should now fall to around 1.2350 as a level with confluence between a key recent swing low and a fairly long-term bullish trend line. Happily, this is exactly what transpired over the remainder of the week, although the price did linger at the trend line for about twenty-four hours before turning around and resuming its long-term upwards trend.

The chart below shows that long-term bullish trend line as the lower border of a consolidating, narrowing triangle that the price has remained within. At the time of writing, the upper border, which is the bearish trend line commencing at the recent multi-year high just below 1.2800, is being testing by the price which is now threatening to break above it.

I am not confident we will get a sustained break today above that line, as it is only the second test. However I think there could be a temporary excursion up to 1.2600 or even approaching 1.2650 which is likely to act as a key resistance.