USD/CAD Signal Update

There are no outstanding signals.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of the broken bullish trend line at around 1.2500.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short after bearish price action on the H1 time frame immediately following the next touch of the bearish trend line at around 1.2570.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

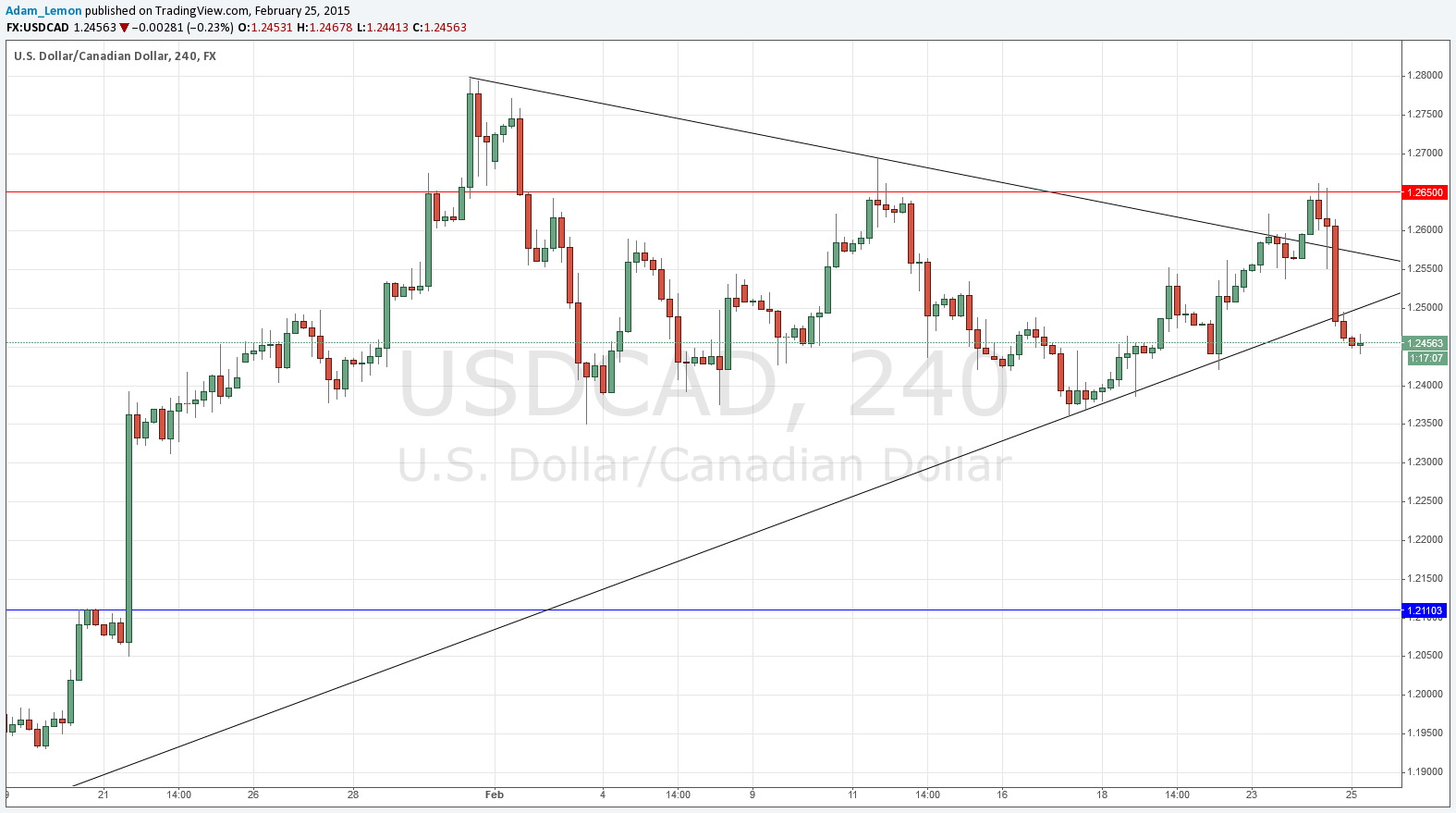

I had forecast the day before yesterday that we were likely to get a temporary excursion above 1.2600 but that we would not exceed 1.2650. This was proved to be correct. The following day we again seemed to break quite smoothly and steadily above the bearish trend line, so the pair seemed to making a sustainable bullish breakout. However, the resistance at around 1.2650 held again, and then there was bearish USD sentiment caused by news during yesterday’s New York session, followed shortly by the same thing in reverse for the CAD, so the pair plummeted. Now we are looking at a bearish breakout of the triangle!

It is interesting to see just how difficult it is to draw any convincing long-term bullish trend lines below where the price is now. Considering that fact in conjunction with the fact that it looks quite free and “gappy” all the way down to 1.2100 convinces me that we are quite probably due for a further strong move down to at least that level in the short term.

The obvious launching pads will be a failed retest of either one of the trend lines.