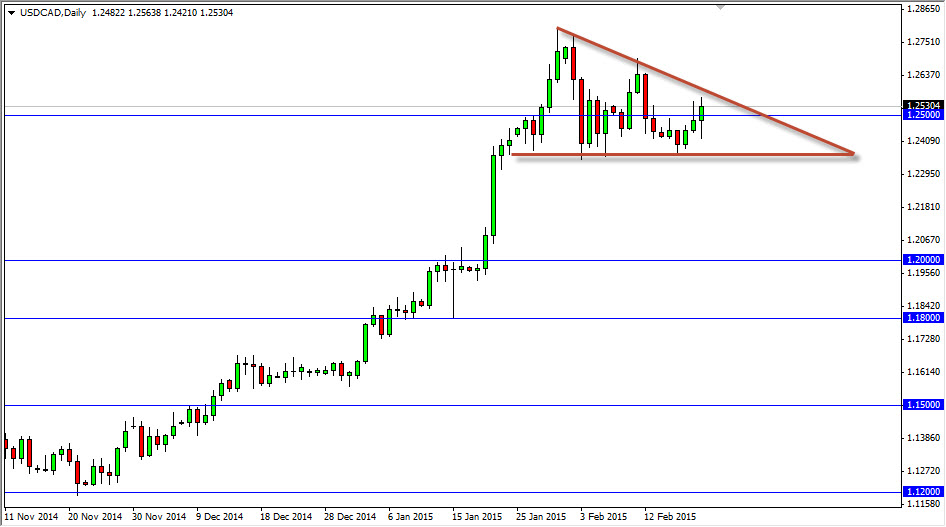

The USD/CAD pair initially fell during the course of the session on Friday, but as you can see found enough support near the 1.24 level to turn things back around and form a nice-looking hammer. That hammer of course suggests that there is buying pressure but I also recognize that we are in the process of potentially forming a descending triangle. That of course is a very sign, so if we break down from here would not surprise me at all based upon the measurement of the potential descending triangle to reach back towards the 1.20 handle.

Because of this, I have no interest in selling this market at all and I look at any break down from here as a potential opportunity to take advantage of value in the US dollar. With that, the market looks as if it is one that you can only go one direction and, and that’s of course long.

Oil markets

Look at the oil markets for some type of clue as to what happens going forward. Remember, the Canadian dollar is very sensitive to what goes on in the oil markets, as Canada is a massive exporter of that particular commodity. I believe that this market will continue to go higher and test the 1.30 level, which of course was the massive resistance that we ran into after the financial crisis. It’s going to take a significant amount of momentum building in order to get above there though, so every time we pullback it should be a buying opportunity.

I have no interest in selling this market, so having said that I am on the sidelines in the meantime, unless of course we break the top of the descending triangle, which of course would negate that and send this market looking for higher levels going forward. Because of this, I am bullish but recognize that we need to wait for a bullish move or a supportive candle in order to start buying.