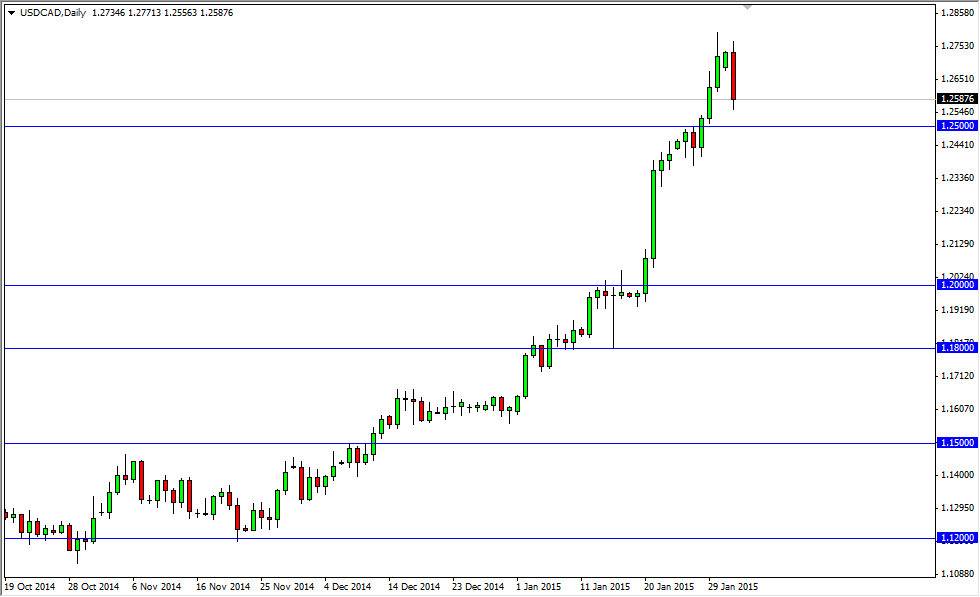

The USD/CAD pair fell during the course of the session on Monday, forming a very bearish candle. That being the case, the market looks as if it’s ready to test serious support down at the 1.25 handle. That area should bring in buyers, but even if it does and I’m not overly worried because I believe the support extends all the way down to the 1.24 handle. On top of that, I believe that the actual “floor” in this market is closer to the 1.20 handle, so therefore I have absolutely no interest in selling this pair at the moment as the US dollar continues to be the strongest currency in the Forex markets, and of course the Canadian dollars to highly leveraged to the petroleum markets. Speaking of that, the oil markets did get a significant bounce during the session, so that probably is what drove this pair lower.

Longer term uptrend should continue

I believe that the longer-term uptrend should continue in this pair, so really at this point in time it’s only a matter of finding a supportive candle. I think that the pair is still heading towards the 1.30 handle, but I am aware the fact that the 1.30 handle was exactly where we turned around last time we rally in this pair is strong as we have been. Because of this, I think that there will be a bit of volatility, but I also recognize that the pair is probably overbought at this point. I would not be surprise at all to see the pullback, or perhaps even just a sideways grind as the market is a bit overdone.

I don’t even have a scenario in which a willing to sell this pair at this point in time, with maybe the exception of massive in shown at the 1.30 handle again, and a massively resistive candle on the longer-term charts. So having said that, I am just waiting for supportive candle in order to take advantage of the value being found at the moment.