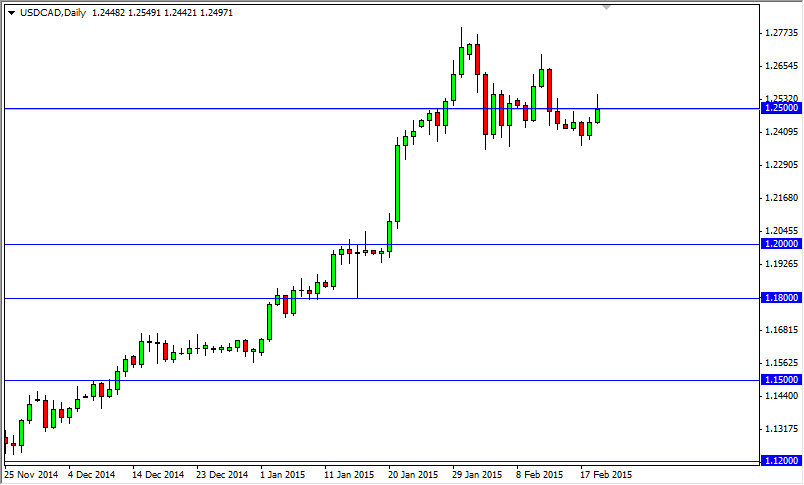

The USD/CAD pair tried to rally during the course of the session on Thursday, but struggled once we got above the 1.25 handle. By doing so, we ended up forming a bit of a shooting star, and it does of course suggests that the market is going to fall. However, there is such support below at the 1.24 level that it’s difficult to sell this pair at the moment. On top of that, even if we broke down below the 1.24 level I feel that there is enough support all the way down to the 1.20 handle to make this a “buy only” type of marketplace. In fact, the lower this pair goes, the more interested I am in going long on support.

If we did break the top of the range for the Thursday session though, I think that is also a decent buy signal as well. However, you have to keep in mind that there is quite a bit of resistance above, and that we are starting to reach fairly historic levels.

The 1.30 level is all important

I believe that the 1.30 level is probably the most important level on the chart quite frankly. This is because it was where the resistance came into play after the financial meltdown. When that happened, this pair shot straight up and slammed into the 1.30 handle. That area was tested several times and then next thing you know market fell directly from there. Because of that, there should be quite a bit of selling pressure in that general vicinity, and that makes me believe that we are going to have to back up several times in order to build up enough momentum to break out above there.

I don’t know if we can do that, but keep an eye on the oil markets as well. They of course have quite a bit of influence on the Canadian dollar, so if well markets fall apart, this pair will more than likely shoot straight up. On the other hand, it works both ways.