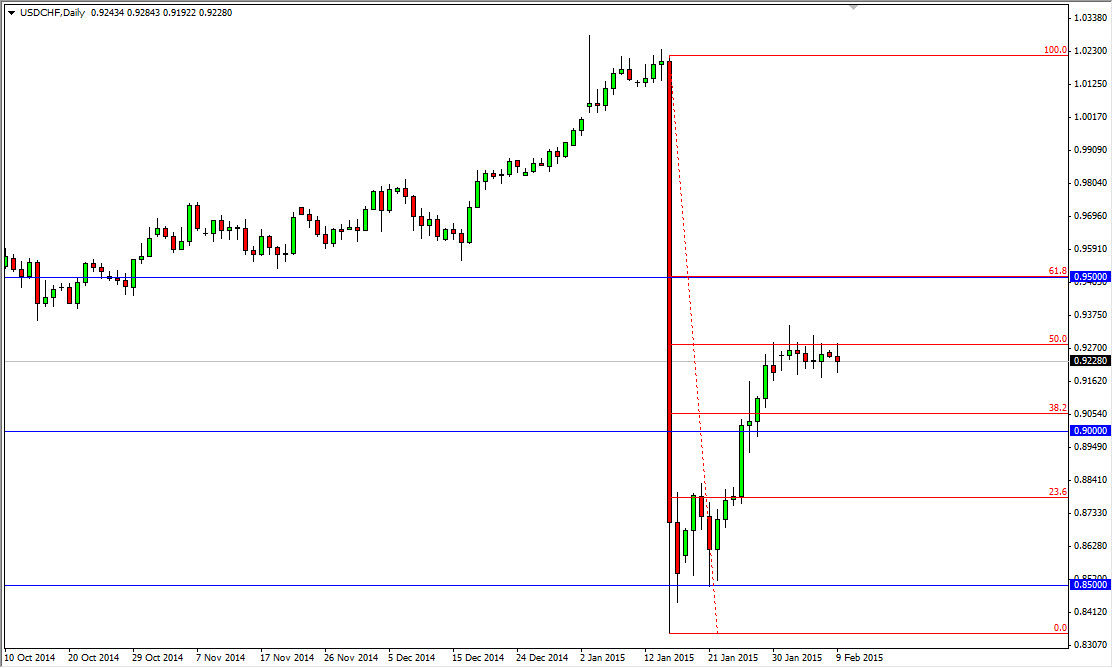

The USD/CHF pair went back and forth during the course of the session on Monday, as we continue to struggle around the 0.9250 level. That area is also the 50% Fibonacci retracement level of the massive selloff that we have seen recently, and as a result I like the idea of selling this pair in this general vicinity. Don’t get me wrong, I would like to see a bit of a breakdown in order to do so, but recognize that we could go sideways for a moment here. In my opinion though, this is a pair that is going to continue going lower, given enough time and more importantly momentum.

If we broke higher though, the markets would more than likely struggle at the 0.95 level which was previously supportive, and now would be resistive. On top of that, it is the 61.8% Fibonacci retracement level which of course is one that brings in a lot of traders and of itself. Because of that, I don’t have a scenario in which a willing to buy this pair, especially considering that the Swiss National Bank released the currency peg against the Euro, resulting in a rapidly appreciating Franc.

Patience will be required

Patience will be required to trade this marketplace, but once we get either the breakdown or the resistance above, I don’t see any reason why this market doesn’t head back down to the 0.88 handle first, and then possibly the 0.85 handle after that. After all, the market will remember the massive selloff that we saw just a few weeks ago, and the massive amount of slippage that formed this ridiculously long red candle.

Because of this, I don’t really see a scenario in which I would be comfortable buying, but I do recognize that the US dollar is stronger than most other currencies right now and as a result this might be a more stable fall in this particular pair than we would see in other CHF related currency pairs. However, I still think the writing is on the wall and we do in fact drift lower.