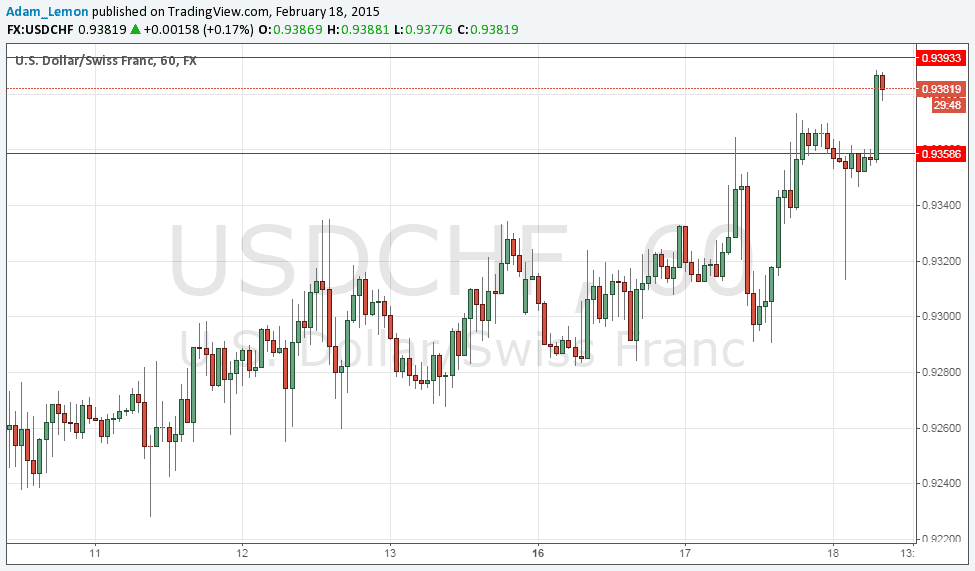

USD/CHF Signal Update

Yesterday’s signals were not triggered because the price did not reach 0.9358 before 5pm London time.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today.

Short Trade 1

Go short after bearish price action on the H1 time frame before the next hourly close above 0.9393.

Place the stop loss 1 pip above the local swing high and in any case above 0.9406.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long after bullish price action on the H1 time frame immediately following the next touch of 0.9166.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

Finally, after more than 2 weeks of consolidating, the price has moved into the anticipated supply zone between 0.9358 and 0.9393. As soon as there is a reversal on the hourly time frame and a move down with some momentum, this should be a good opportunity for a short trade. If the price breaks out strongly above 0.94, that will be a very bullish sign and the area at 0.9400 would probably flip to become supportive.

There are no events scheduled for the EUR today. Regarding the USD, at 1:30pm London time there will be a release of Building Permits and PPI data. After the close at 7pm London time, there will be a release of FOMC Meeting Minutes which should be the most important news event of the day.