USD/CHF Signal Update

Last Thursday’s signals were not triggered as there was no bearish price action when the price hit 0.9130.

Today’s USD/CHF Signals

Risk only 0.25% per trade.

Trades must be entered before 5pm London time only.

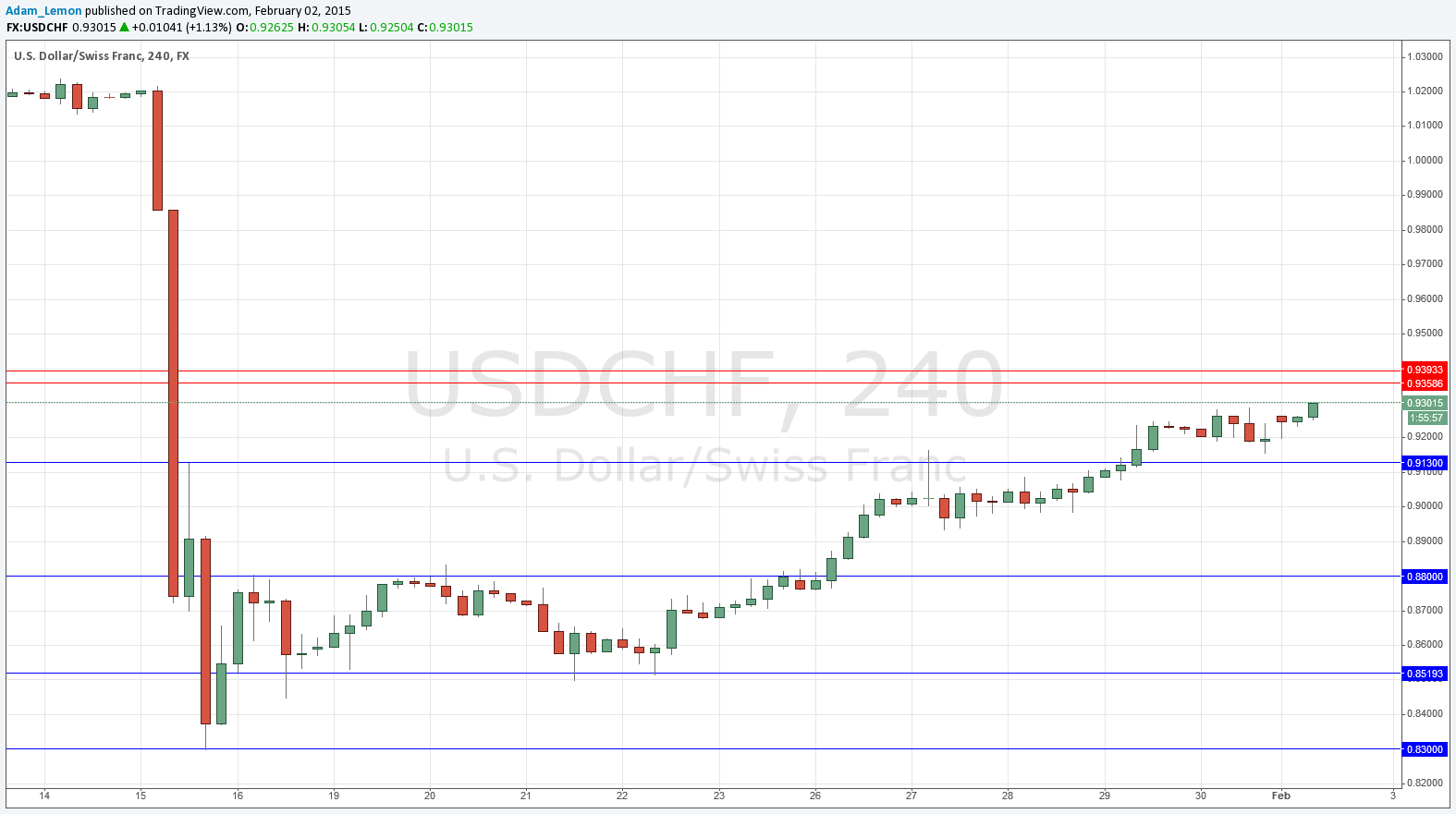

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 0.9358.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 40 pips in profit.

Take off 50% of the position as profit when the trade is 40 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short after bearish price action on the H1 time frame immediately following the next touch of 0.9393.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 40 pips in profit.

Take off 50% of the position as profit when the trade is 40 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long after bullish price action on the H1 time frame immediately following the next touch of 0.9130.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 50 pips in profit.

Take off 50% of the position as profit when the trade is 50 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

Last Thursday I was looking for a bearish reversal at 0.9130. The price shot up right through this level very easily early in the London session that day, and proceeded to rise sharply. The CHF has now recovered a surprisingly large amount of the ground it gave up when the SNB removed its cap on the currency.

We may expect the level at 0.9130 to flip to become likely support. Above, there are now two levels in sight, identified in the detailed signals above, that acted as support in the weeks leading up to the removal of the cap. These levels may now act as resistance, or a resistant zone.

Due to the strong volatility, be very careful in judging the price action is suitable before entering any trades.

There is a high-impact data release scheduled today concerning the USD, but nothing regarding the CHF. At 3pm London time, there will be a release of U.S. ISM Manufacturing PMI data.