USD/CHF Signal Update

There are no outstanding signals.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today.

Short Trade 1

Short entry after bearish price action on the H1 time frame before the next hourly close above 0.9522.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next touch of 0.9338.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

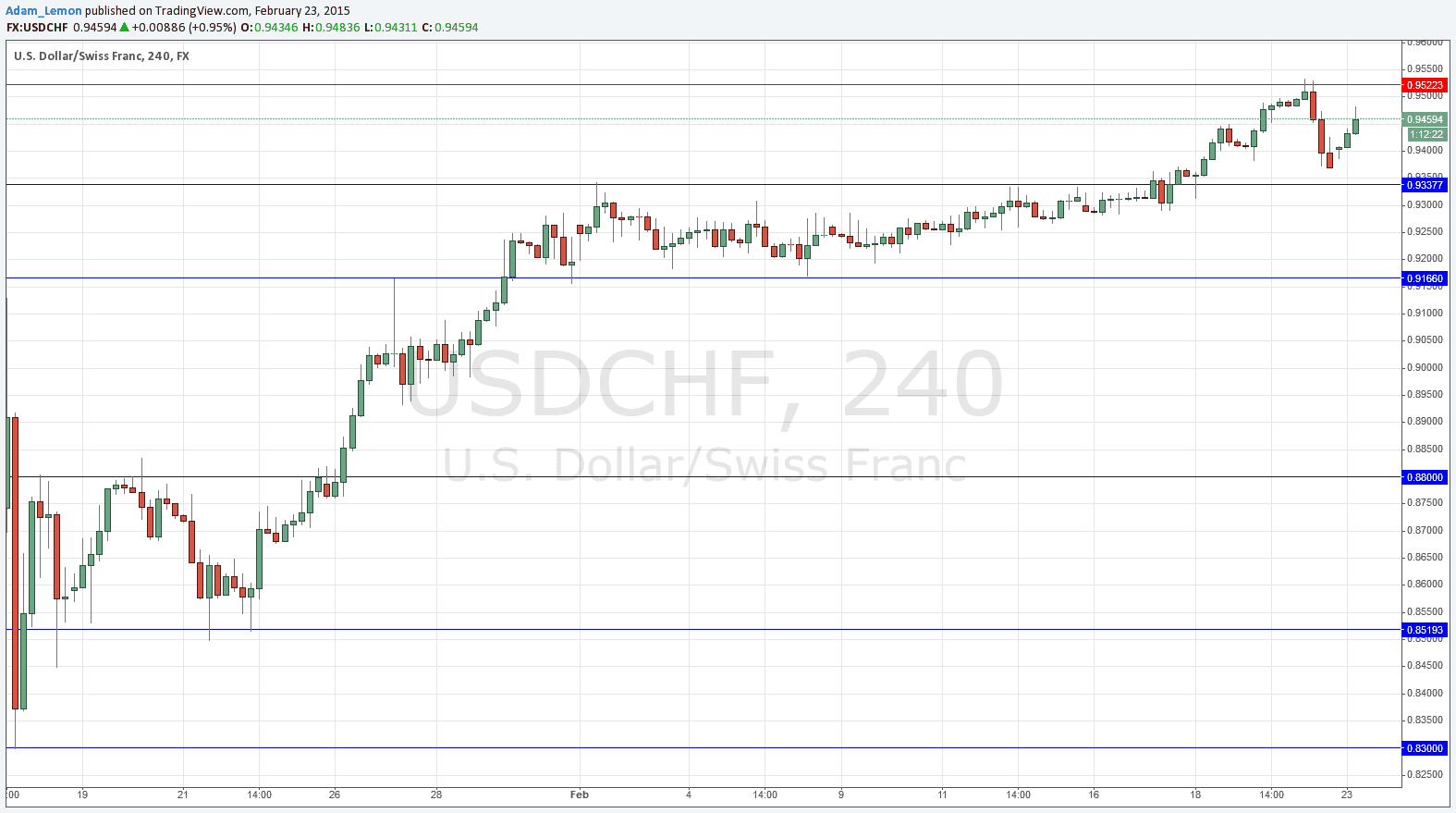

USD/CHF Analysis

After spending more than 2 weeks consolidating, the price finally broke up past key resistance at 0.94 and appeared to be set for the CHF to continue its strong post-shock price rise. However, the pair seems to have hit previous support turned into resistance confluent with the key psychological number of 0.9500, and it finished the week reversing strongly from its high of 0.9534. I see the key level as at 0.9522 and would look for a short there even if the price manages to return to this level later today.

Below, the previous resistance at 0.9338 is an obvious area for a long reversal.

There are no high-impact events scheduled for either the USD or the CHF today. It is likely to be a quiet day for this pair.