USD/CHF Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be made before 5pm London time.

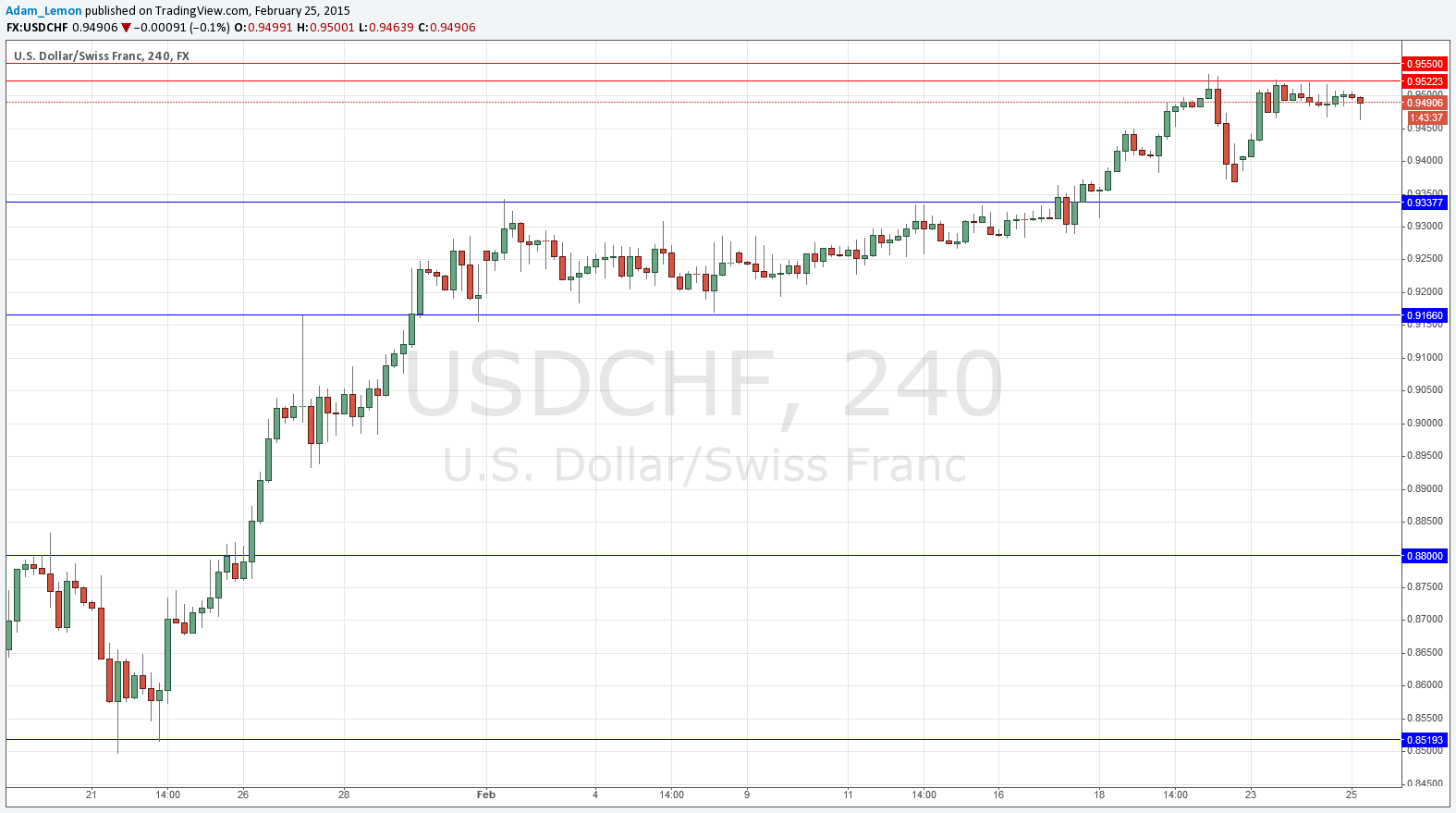

Short Trade 1

Short entry after bearish price action on the H1 time frame before the next hourly close above 0.9550.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next touch of 0.9338.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

I had thought yesterday that the resistance at 0.9522 would not hold but I was wrong, it is holding, but this is probably due only to the relative weakness of the USD right now.

The level at 0.9522 looks untrustworthy but a reversal off a push up to 0.9550 would be a great location for a short trade off a price action reversal.

There are no high-impact events scheduled for the CHF today. Regarding the USD, at 3pm London time there will be a release of U.S. New Home Sales data and the Chair of the Federal Reserve will begin her testimony before the House Financial Services Committee.