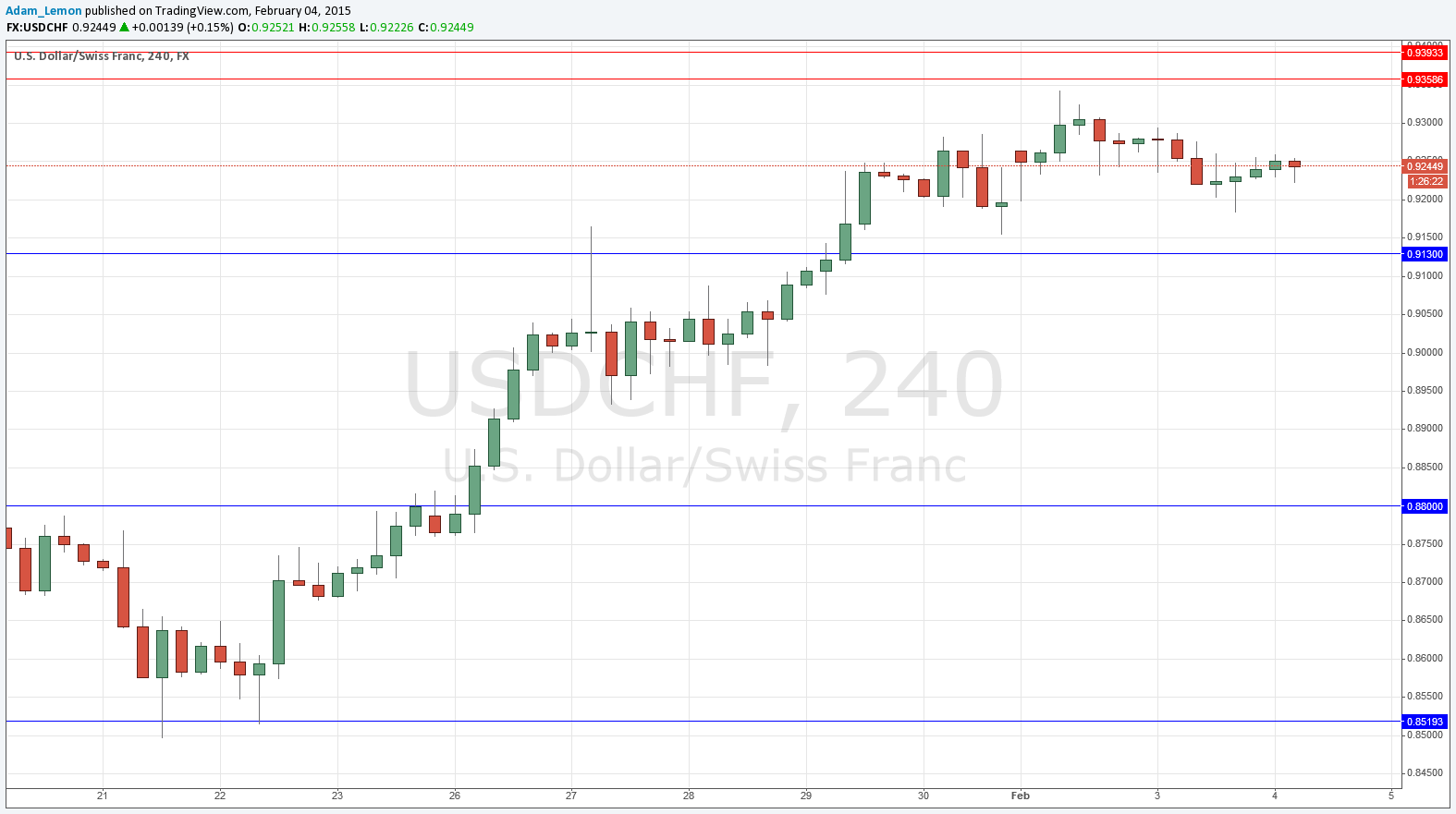

USD/CHF Signal Update

Yesterday’s signals were not triggered and expired.

Today’s USD/CHF Signals

Risk only 0.50% per trade.

Trades must be entered before 5pm London time.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 0.9358.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 35 pips in profit.

Take off 50% of the position as profit when the trade is 35 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short after bearish price action on the H1 time frame immediately following the next touch of 0.9393.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 35 pips in profit.

Take off 50% of the position as profit when the trade is 35 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long after bullish price action on the H1 time frame immediately following the next touch of 0.9130.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 35 pips in profit.

Take off 50% of the position as profit when the trade is 35 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

For the second day running, none of the key levels identified previously were touched; there is no real technical change from yesterday. Additionally, the CHF is finally slowing down and starting to exhibit a more normal volatility, as it finally moves away from the centre stage – at least for the time being.

There are no high-impact data releases scheduled for later today concerning the CHF. Regarding the USD, at 1:15pm London time there will be a release of the ADP Non-Farm Employment Change data, followed later at 3pm by the ISM Non-Manufacturing PMI data release. This pair is likely to be more active during the New York session than the earlier London session.