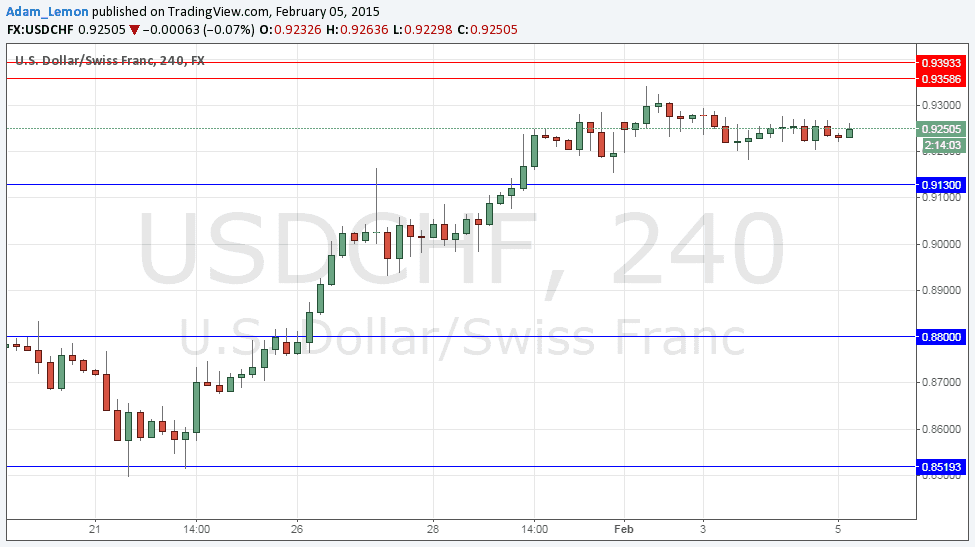

USD/CHF Signal Update

Yesterday’s signals expired without being triggered as the price never reached either0.9358 or 0.9130.

Today’s USD/CHF Signals

Risk only 0.50% per trade.

Trades may only be made between 8am and 5pm London time.

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next touch of 0.9358.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 35 pips in profit.

Remove 50% of the position as profit when the trade is 35 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry after bearish price action on the H1 time frame immediately following the next touch of 0.9393.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 35 pips in profit.

Remove 50% of the position as profit when the trade is 35 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next touch of 0.9130.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 35 pips in profit.

Remove 50% of the position as profit when the trade is 35 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

For the third consecutive day, none of the key levels identified previously have been touched; there is no real technical change from yesterday. The CHF has calmed down for now and seems to be consolidating within a more normal price range.

There are no high-impact data releases scheduled for later today concerning the EUR. Regarding the USD, at 1:30pm London time there will be releases of U.S. Unemployment Claims and Trade Balance data. This pair is likely to be more active during the New York session than the earlier London session.