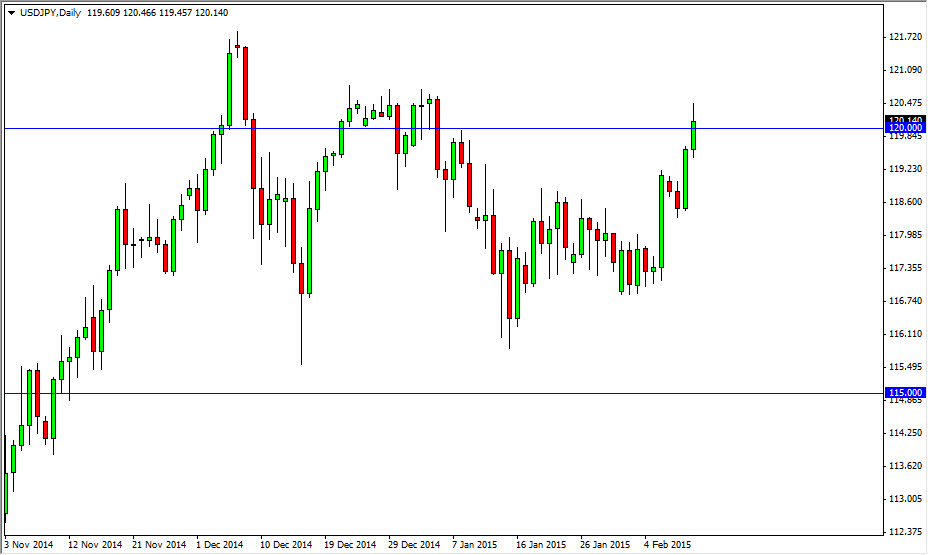

The USD/JPY pair broke above the 120 level during the session on Wednesday, as the big figure finally got broken again. However, there is a bit of resistance all the way to the 121 handle, and the 122 handle above there. In other words, I think that we are going to struggle to go higher here for the short-term but it’s only a matter of time before the buyers finally break out and push this pair much higher.

On top of that, you have to keep in mind that the two central banks are on completely different paths at this point in time. After all, the Bank of Japan has been extraordinarily loose monetary policy at this point in time, while the Federal Reserve continues to look like they are going to tighten rates sometime in the next year or so. With that, the interest rates between the two currencies should continue to expand, and that of course will drive more money into the US dollar.

Another thing that you need to watch…

After the Friday jobs report, bond yields in the United States rose rather significantly. While bonds didn’t sell off completely to break the trend higher, it does look like there is a real threat of that happening. If the US bond market starts to offer more in the way of interest-rates that will drive the US dollar higher as well. Truthfully, the Japanese yen offers no return as far as interest is concerned, and Japanese Government Bonds or even worse at times. In other words, this is a one-way trade that could go for a very long time.

If we can get above the 122 handle, I don’t see any reason why we don’t go to 125, and then much higher than that given enough time. I think pullbacks continue to offer buying opportunities, as there is plenty of support below and quite frankly the US dollar still reigns supreme over just about everything but the Swiss franc at this point in time.