USD/JPY Signal Update

Last Thursday’s signals were not triggered and expired.

Today’s USD/JPY Signal

Risk 0.75%

Trades may be entered only between 8am London time and 5pm New York time, and then after 8am Tokyo time later.

Short Trade 1

Short entry following bearish price action on the H1 time frame immediately after the price first reaches 119.94.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

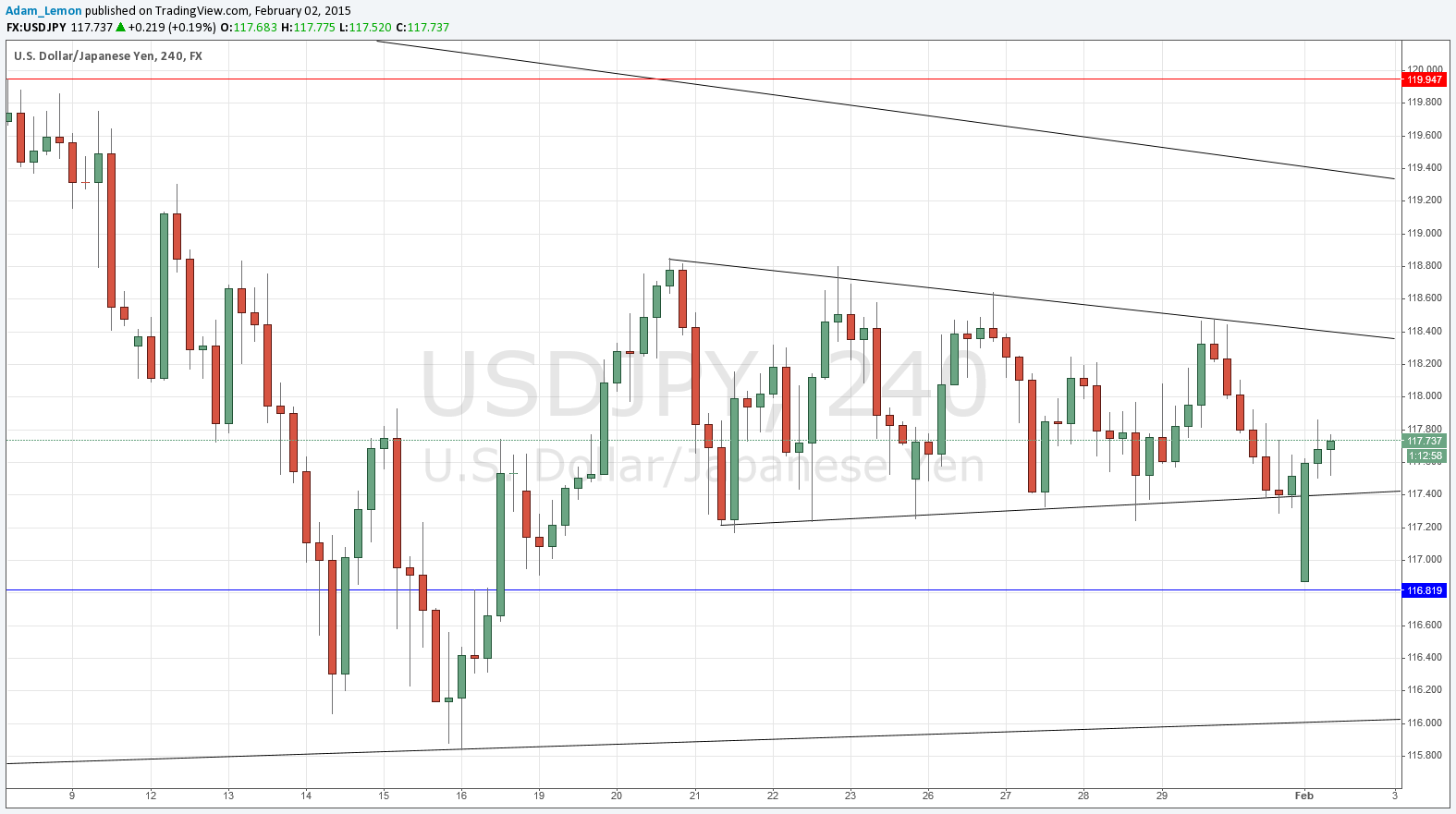

Right up until the end of last week, the price held within the narrow triangle while we all waited for the break, which I had seen as indicating which of either the support or resistance would be the first to be hit. Funnily enough, the price gapped down last night and opened (at least according to my price feed) just above the support I had seen at 116.82, and it immediately began to rise strongly for there, and has been rising ever since. The price is now back within the narrow triangle.

As we have effectively already triggered 116.82, I would not be looking for another long there just yet, so all that is left is the likely resistance at 119.94. To a lesser extent, the bearish trend line of the narrow triangle is probably also going to act as resistance, and could provide a nice short scalp or even a short-term bearish swing trade.

There is a high-impact data release scheduled today concerning the USD, but nothing regarding the JPY. At 3pm London time, there will be a release of U.S. ISM Manufacturing PMI data.