USD/JPY Signal Update

Yesterday’s signal was not triggered and expired.

Today’s USD/JPY Signal

Risk 0.75%

Trades must be made between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Short Trade 1

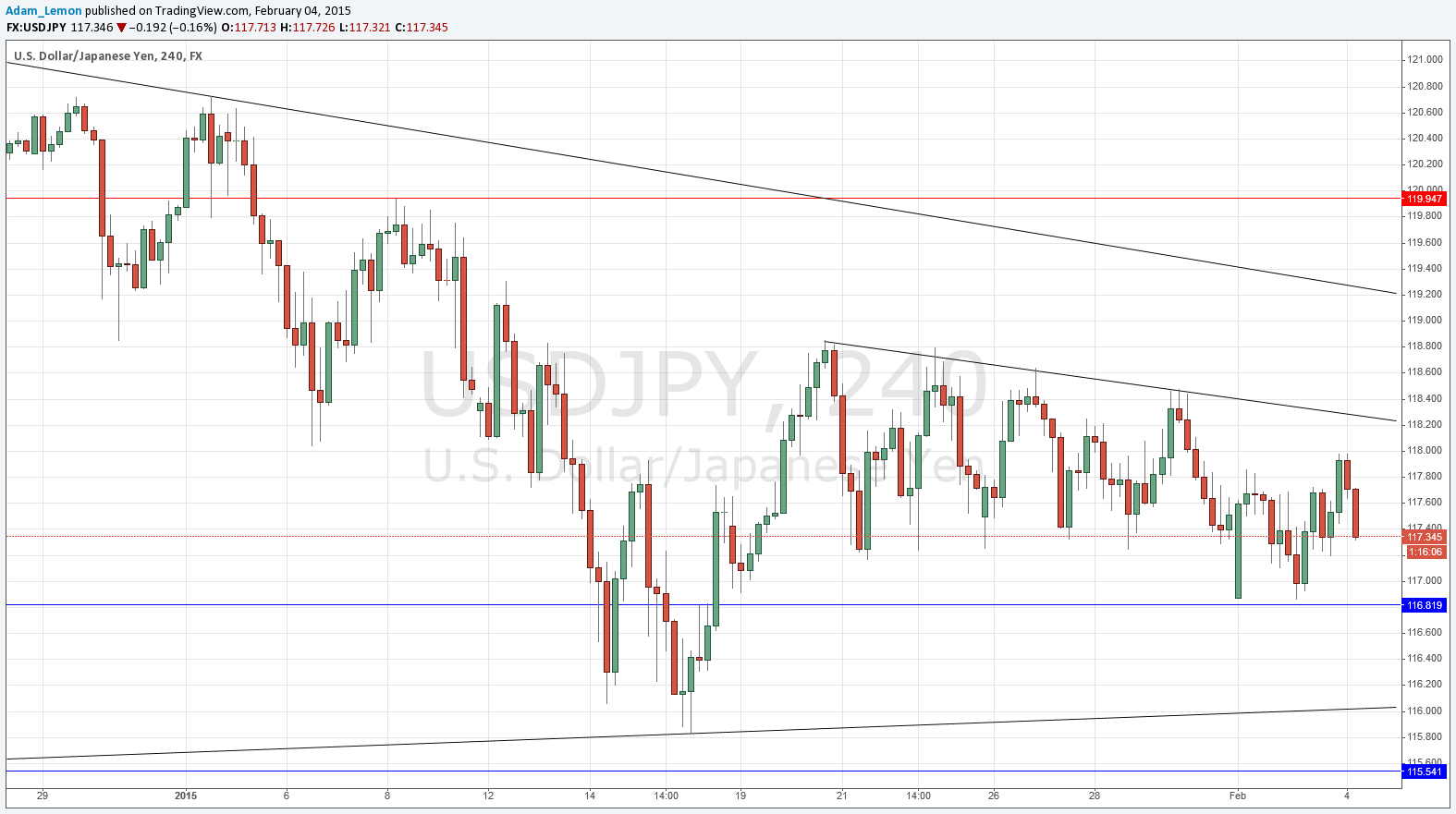

Short entry following some bearish price action on the H1 time frame immediately upon the first touch of the bearish trend line above, currently sitting at about 118.20.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry following some bullish price action on the H1 time frame immediately upon the first touch of 116.82.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

Again, this pair remains flat and range-bound. The only development today is that the level at 116.82 should be ready to come into play again as potentially good support as the price has not been there for a while.

The action is very choppy, but is a little more suggestive of a coming move down rather than up. Therefore a short off the nearest bearish trend line is likely to be the best trade opportunity coming in the near future.

There are no high-impact data releases scheduled for later today concerning the JPY. Regarding the USD, at 1:15pm London time there will be a release of the ADP Non-Farm Employment Change data, followed later at 3pm by the ISM Non-Manufacturing PMI data release. This pair is likely to be more active during the New York session than the earlier London session.