USD/JPY Signal Update

Last Thursday’s signals expired without being triggered.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Short Trade 1

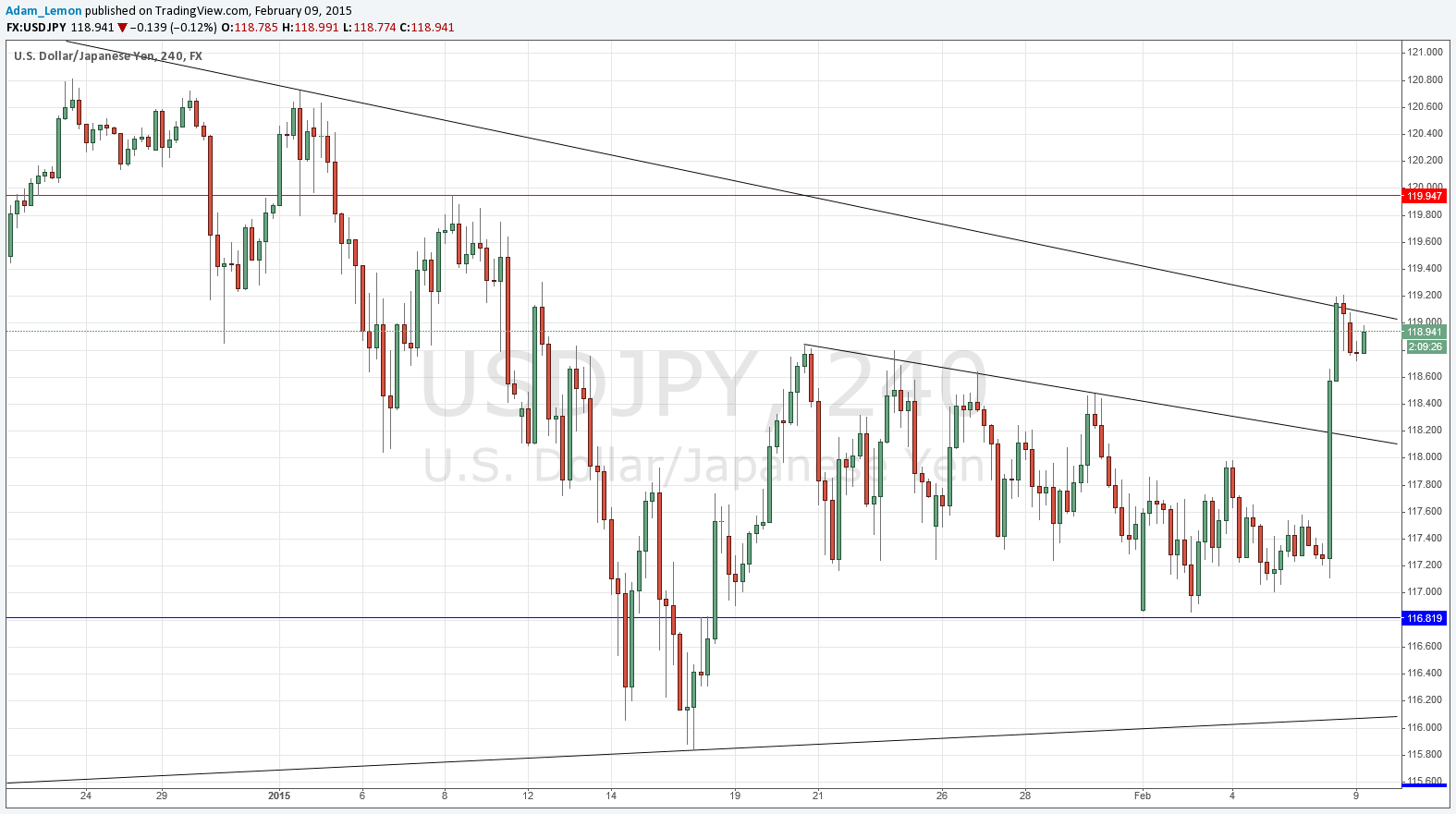

Short entry following some bearish price action on the H1 time frame immediately upon the first touch of the bearish trend line above, currently sitting at about 119.94.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Go long following some bullish price action on the H1 time frame immediately upon the first retest of the broken bearish trend line shown on the chart below the current price. The trend line is currently sitting at around 118.16..

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

Finally we have some real action on this pair with a strongly bullish breakout of the narrowest triangle formation occurring last Friday. The break of this inner trend line suggests bullishness, in line with the very long-term trend. Note however that the move up has paused at the top of the wider, longer-term triangular upper trend line. This may prove to be resistant enough to give us a move down and retest of the broken inner trend line at around 118.16 which could then give an opportunity to go long.

There is a key resistance level above very close to the big whole number of 120.00 that could provide strong resistance and therefore it might be a good place to take some profit off a long, or at which to look for a short off bearish reversal price action.

There are no high-impact data releases scheduled for later today concerning either the JPY or the USD. Therefore it is likely to be a very quiet day for this pair, unless there is unforeseen news.