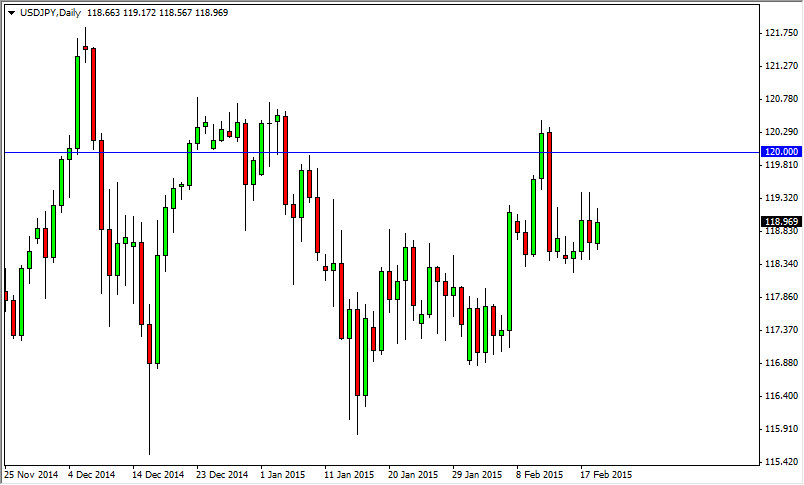

The USD/JPY pair rose during the course of the session on Thursday, as we continue to grind around the 119 level. With that being the case, it looks as if the market is ready to continue to fight towards the 120 handle, and then perhaps the 122 handle given enough time.

I think that the industry differential between the two currencies will continue to expand, especially considering that the Bank of Japan has an ultra-easy monetary policy while the Federal Reserve looks set to start tightening monetary policy given enough time. That being said I don’t necessarily think that this is going to be an easy ride, and it will more than likely be very choppy between here and the 122 level. However, over longer-term scenarios I believe that this market continues to go higher and will eventually offer a bit of a “buy-and-hold” type of situation.

Support below

I believe that there is a massive amount of support below, starting at the 118 handle. I also see quite a bit of support at the 117 handle, and the 116 handle. In fact, I think that the actual “floor” in this market is probably at the 115 level, so in other words I think there is simply far too much in the way of noise below in order to start selling. With that, the market will more than likely be one that eventually finds buyers, and with that the market is essentially “long only.”

The 115 level been broken to the downside would be pretty negative, and as a result the market would change completely at that point in time as far as I’m concerned. However, I highly doubt that we are anywhere near be able to do that. In fact, the market should eventually provide a long-term trade opportunity for those who are more long-term focused. However, you are going to have to be very patient to see this move happen as the market is taking a break after such an impulsive move higher.