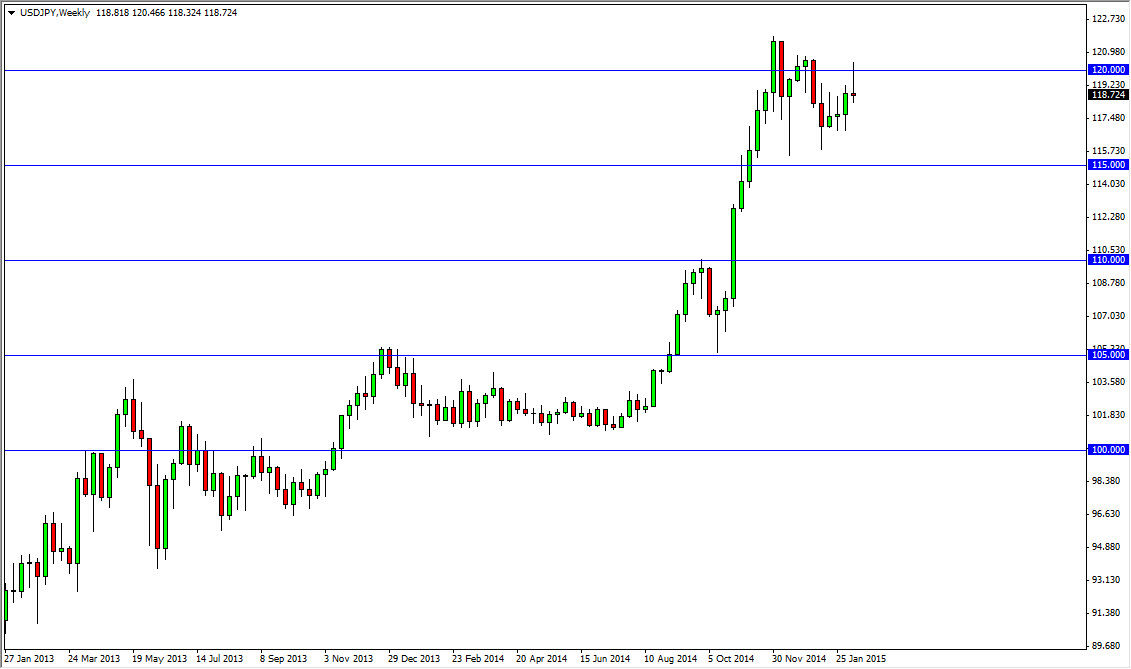

USD/JPY

The USD/JPY pair broke higher during the course of the week, and even cleared of the 120 level at one point. However, we had enough resistance to turn things back around and form a bit of a shooting star. That shooting star of course is a negative sign and suggests that the market is going to fall from here. However, I believe that there is enough support near the 115 level to pick this market up again. In fact, we could very well be trying to form some type of bullish flag. I would look for supportive candles below in order to take advantage of value.

EUR/USD

The EUR/USD pair had a very back and forth week over the last five sessions, but we still remain below the 1.15 level. On top of that, the previous week formed a shooting star, so I think there is still a significant amount of downward pressure on the Euro overall. With that, the market will more than likely fall from here, but we may have to test the 1.15 level first. Either way, I have no interest in buying this pair.

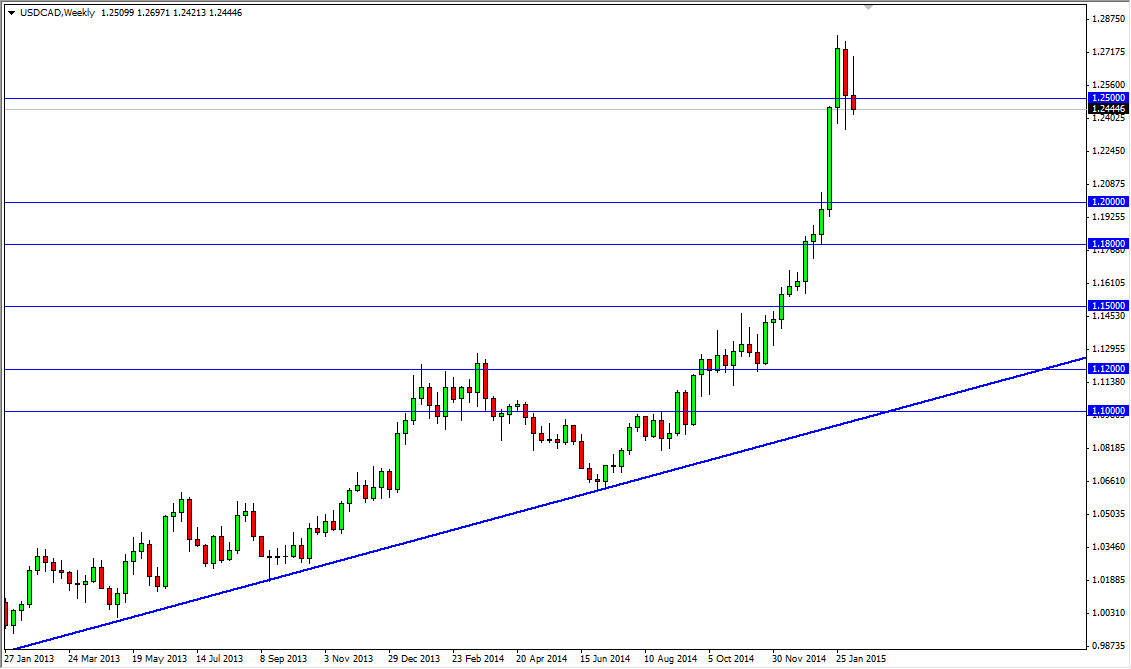

USD/CAD

The USD/CAD pair initially broke higher during the course of the week, continuing to consolidate above the 1.25 handle. However, by the end of the week when it up forming a shooting star of sorts, and I feel now that this pair could pull back. That’s not to say that I am interested in selling, I just simply think that we will get value reintroduced into this pair somewhere near the 1.20 handle. I am simply going to step back and let it fall in order to pick up the US dollar “on the cheap.”

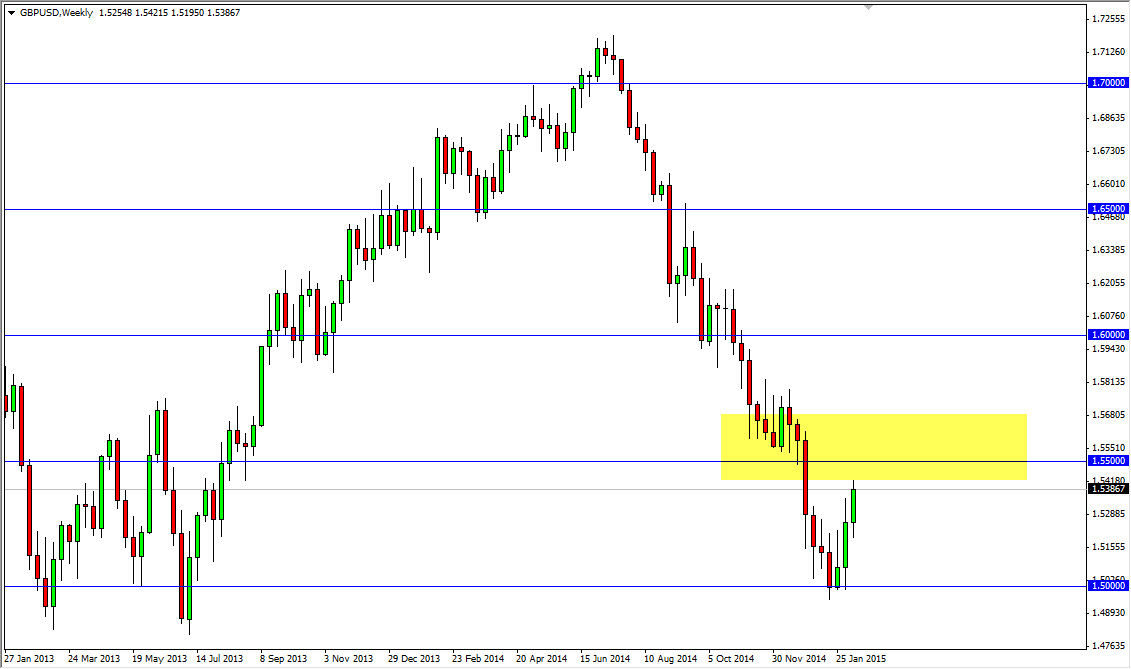

GBP/USD

The GBP/USD pair broke higher during the course of the week, as it looks set to test the 1.55 level. That level was previously supportive, so I think it will be resistance now. With that, the market will more than likely go a little bit higher before selling off. I am simply going to wait until we get a resistant candle closer to the 1.55 level in order to start selling the GBP/USD pair yet again.