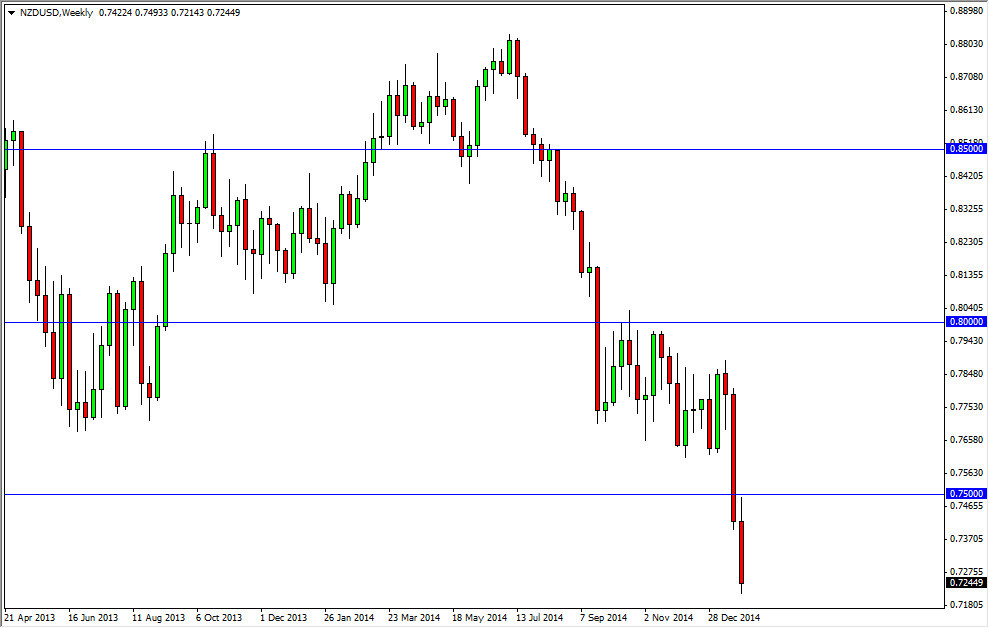

NZD/USD

The NZD/USD pair initially tried to rally during the course of the week, but found enough trouble at the 0.75 level to turn things back around and fall rather drastically. This of course was because the Royal Bank of New Zealand mentioned that a rate cut wasn’t impossible at this point in time, and that of course has the markets worrying about potential actions coming out of Wellington. With that being the case, I feel that this market heads down to the 0.70 level given enough time.

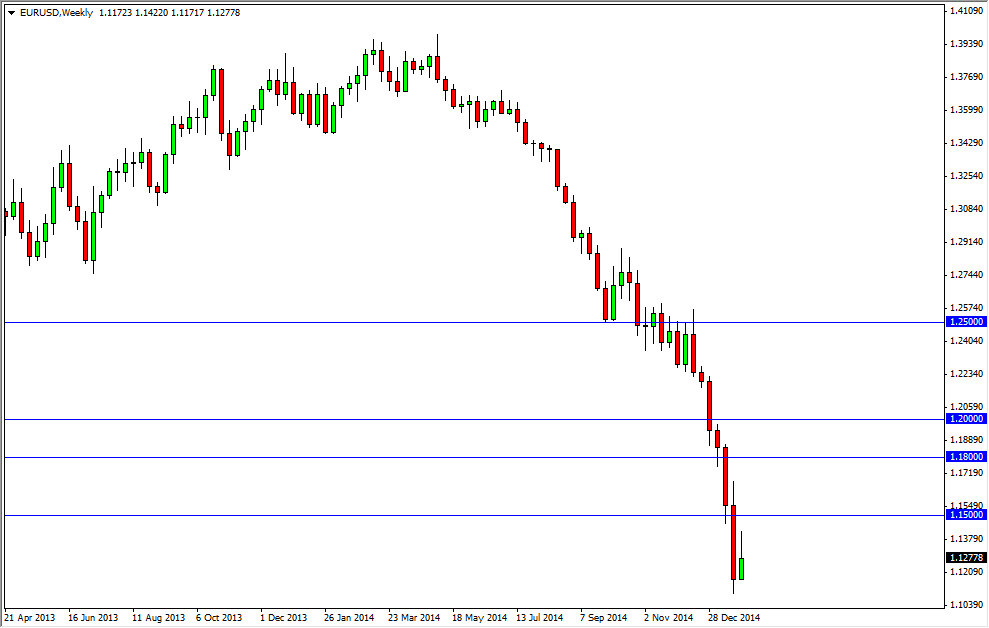

EUR/USD

The EUR/USD pair initially broke higher during the course of the week as the market trying to reach for the 1.15 handle. That’s an area that should be resistive though, and the fact that we pulled back and formed a shooting star only confirms this. That means that we should continue to see bearish pressure, and that should of course send this market lower. I believe that the Euro should continue to weaken at this point in time, as we should then head down to the 1.10 level.

GBP/USD

The GBP/USD pair initially tried to rally during the course of the week, but sold off rather drastically. The shooting star that sits at the 1.50 level looks as if it is a sign that the market is going to continue to go lower, but I see a significant amount of noise only down to the 1.48 level that should be somewhat supportive. With that, I believe that this market does go lower, but it might be a bit choppy. All rallies will be sold by me.

EUR/CHF

The EUR/CHF pair broke much higher during the course of the week, slamming into the 1.05 level. However, that is a large, round, psychologically significant number and we did of course form a shooting star at that region on Friday. That suggests to me that the market should sell off relatively soon, but if we break above the 1.05 level, I am more than willing to sell resistive candles at higher levels as well. I have no interest whatsoever in selling this market after the shenanigans out of the Swiss National Bank.