By: DailyForex.com

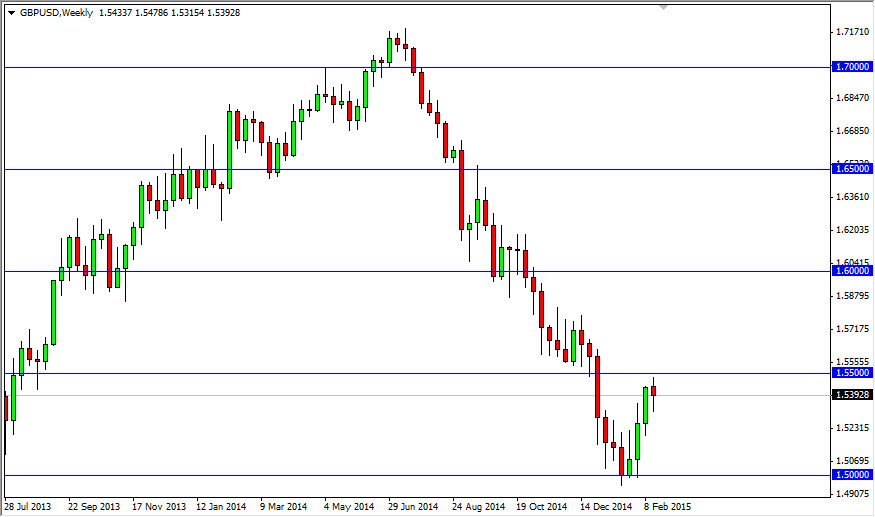

GBP/USD

The GBP/USD pair went back and forth during the course of the week, struggling at the 1.55 level with significant resistance. The neutral candle suggests that the market is more than likely going to continue to find trouble here, but ultimately we should break down below the bottom of the range for the week, and that should send the sellers back into the marketplace. The 1.50 level below should be massively supportive, so we do not anticipate any type of meltdown from here.

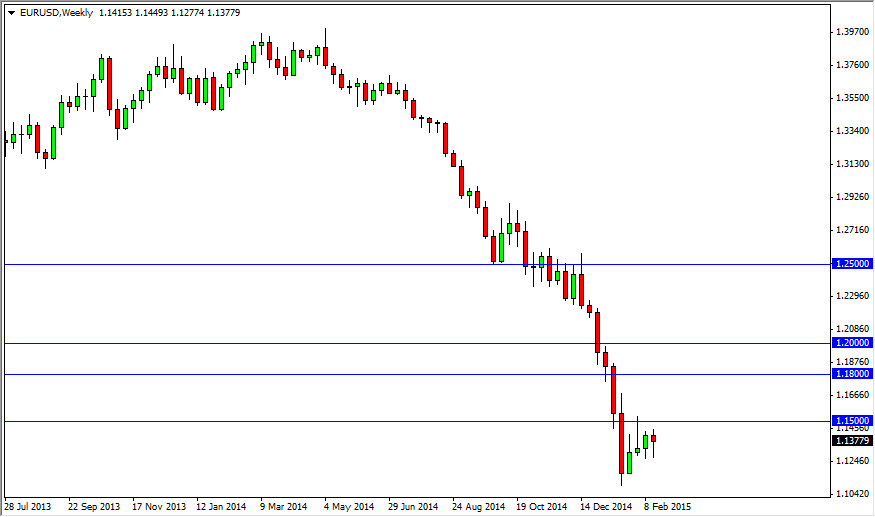

EUR/USD

The EUR/USD pair fell during the course of the week, but found enough support below to turn things back around at the 1.13 region. It appears of the market is ready to continue consolidating between 1.13 on the bottom, and the 1.15 level on the top. Ultimately, this is not a market that I think long-term traders will be involved in, so quite frankly we will step on the sidelines.

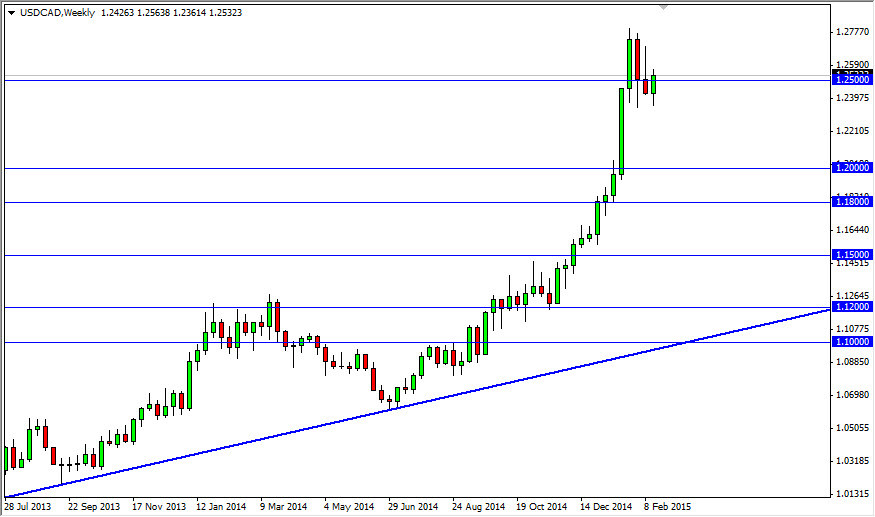

USD/CAD

The USD/CAD market initially fell during the course of the week but found enough support in order to break higher and clear the 1.25 handle. It looks like we are continuing to go higher but within the consolidation range. At this point in time, it appears of the market will probably go to the 1.28 level next, but getting above the 1.30 level will be a completely different question as it was the area of significant resistance that the market found after the financial break down years ago.

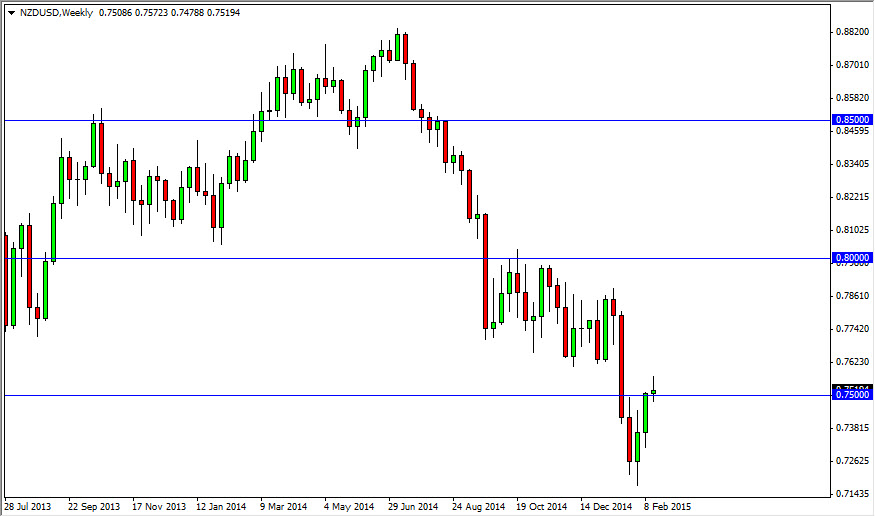

NZD/USD

The NZD/USD pair broke higher during the course of the week, but gave back almost all of the gains in order to form a nice-looking shooting star. The shooting star sits right on the 0.75 handle, so if we can break below the bottom of the range for the week, I feel the market goes back down towards the 0.7150 handle given enough time. Ultimately, I am very bearish of this market and believe that sooner or later we will test the lows.