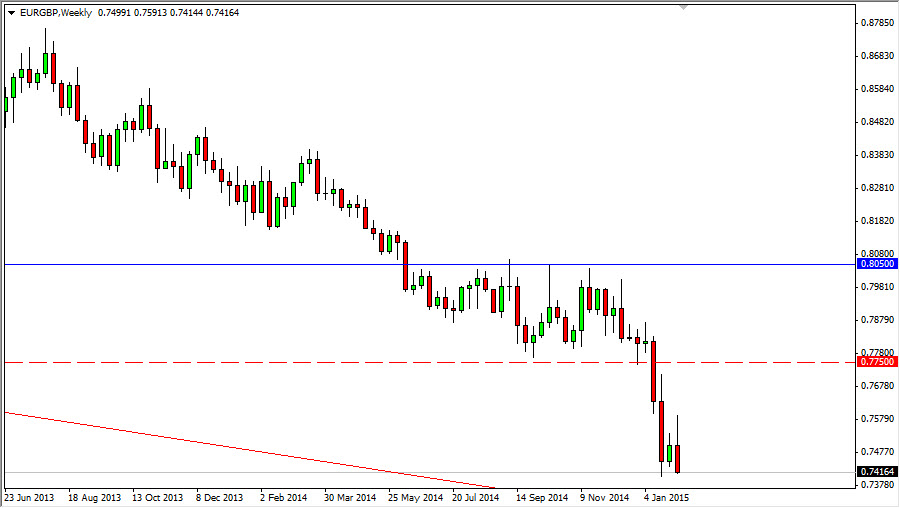

EUR/GBP

The EUR/GBP pair initially tried to rally during the course of the week, but as you can see struggled at the 0.76 handle. By doing so, we turned back around and fell below the 0.75 handle, closing near the 0.74 level. Because of this, it appears that the pair will continue to fall, as a move below the 0.74 level of course is very bearish and becomes a fresh, new low. I am a seller of rallies and breakdowns in this particular pair.

EUR/USD

The EUR/USD pair initially tried to rally during the course of the week, but as you can see struggled at the 1.15 handle. This of course is a large, round, psychologically significant number so of course the market would find sellers there. By doing so, we ended up forming the perfect shooting star that you see, and as a result it appears the market is ready to continue going lower. I believe that this market goes down to the 1.10 handle given enough time, and will of course play it as such.

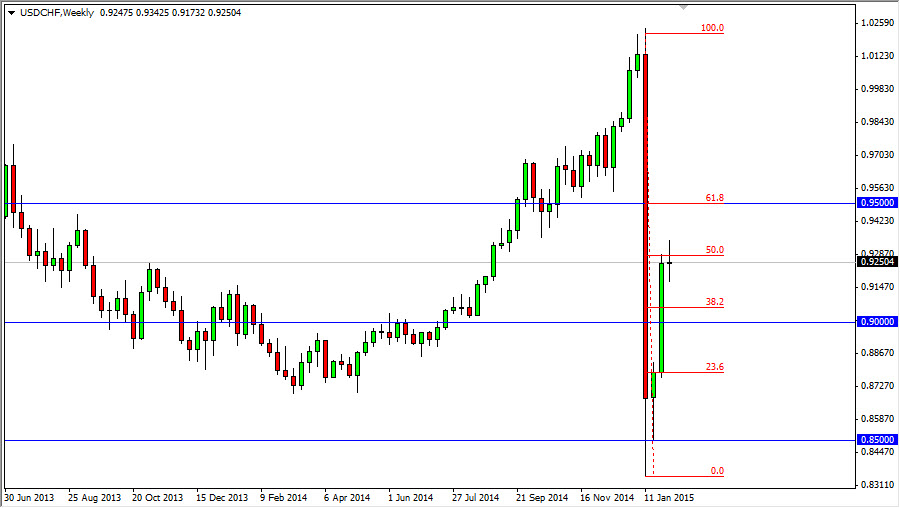

USD/CHF

The USD/CHF pair struggled during the course of the week and ended up basically unchanged. With that being the case, we continue to struggle at the 50% Fibonacci retracement level from the massive selloff. If we can break down below the bottom of the range, I would be a seller. On the other hand though, if we break above the top of the range I am simply going to wait until we get to the 0.95 level to start selling again.

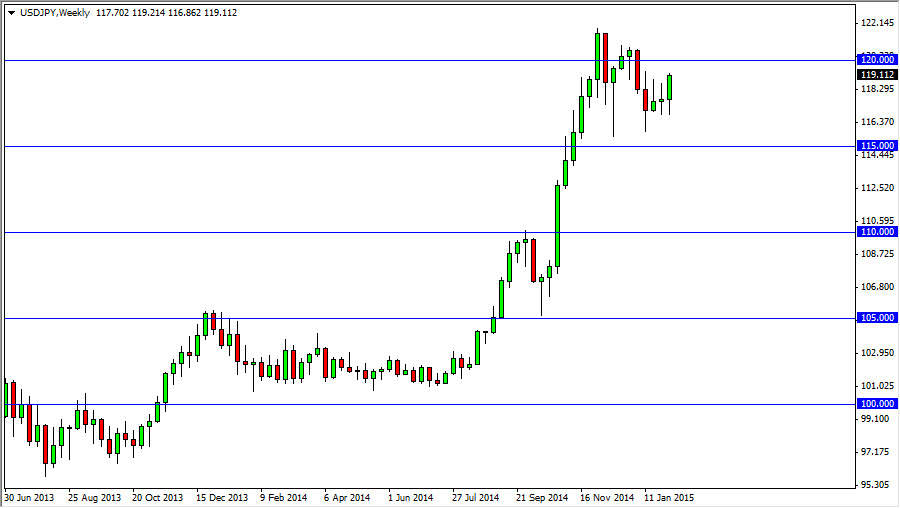

USD/JPY

The USD/JPY pair initially fell during the course of the week, but found enough support near the 117 level to turn things back around. A stronger than anticipated nonfarm payroll number of course didn’t hurt either, and it now appears that we are ready to continue the uptrend. If we can break above the 120 level, we should work our way towards 122. Pullbacks should continue to be buying opportunities.