AUD/USD Signal Update

Last Thursday’s signal was not triggered as the price never quite reached 0.7600.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

Go long following some bullish price action on the H1 time frame immediately upon the next test of the bullish trend line currently sitting at around 0.7630.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

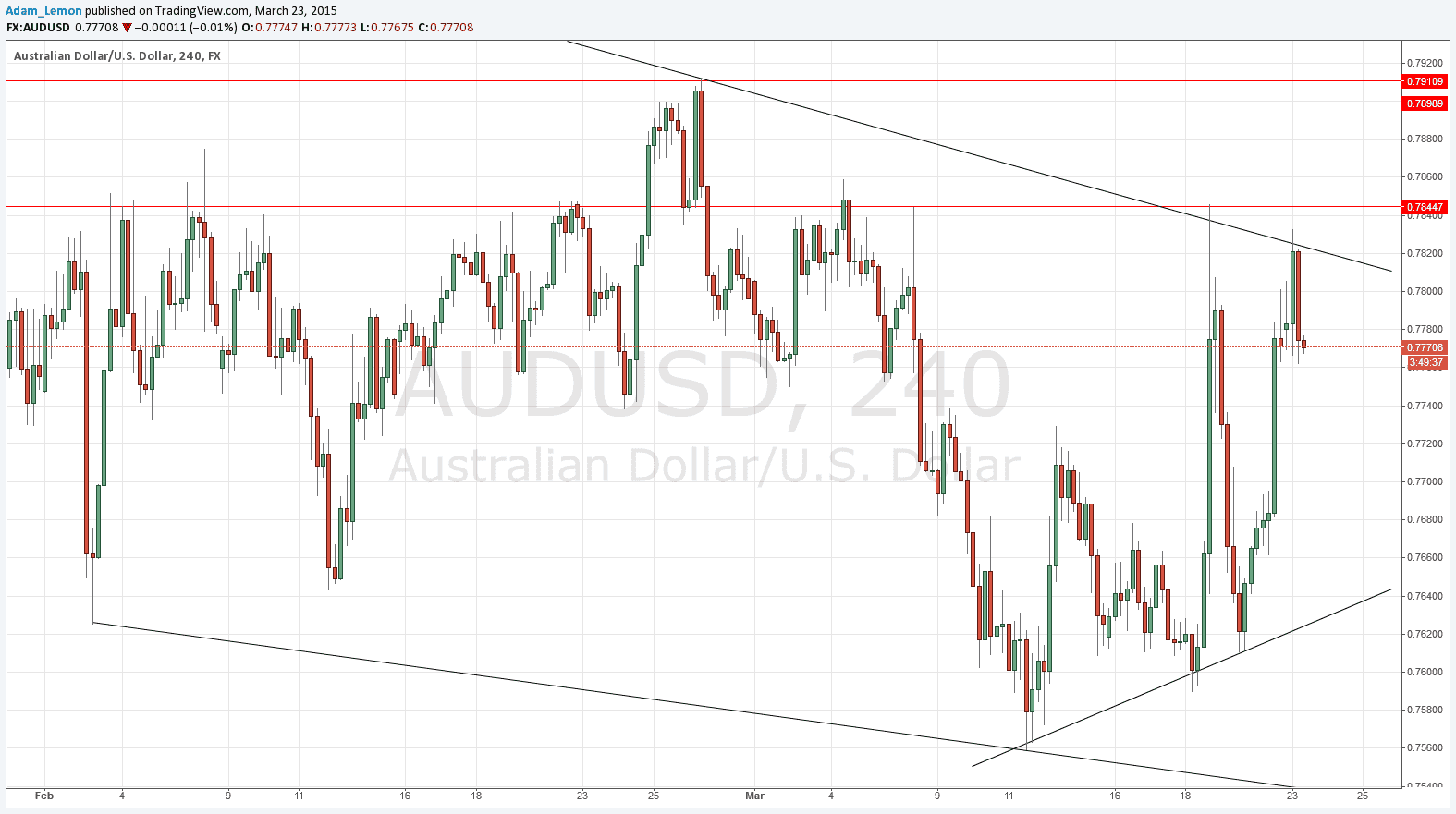

Go short following some bearish price action on the H1 time frame immediately upon the next test of the bearish trend line currently sitting at around 0.7821.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

I had forecast a bullish bounce was likely last Thursday off 0.7600. Unfortunately the price turned around 10 pips before reaching that level. In early trading after this week’s open, the price has bounced bearishly off a long-term bearish trend line.

There are two conflicting ways of looking at the larger technical picture. Firstly, that we are in a consolidating triangle, with a lower trend line that is quite steep, albeit short term, but with two touches. The upper trend line is well-established. Alternatively, it could be said that we are tentatively within a bearish channel, although the lower trend line of this channel is not well established. In any case, a downwards move off the bearish trend line of either possible formation would seem to have the greater likelihood of producing a better profit. However it might be a little late to get in now, but a pull-back higher with another break down could provide a good shorting opportunity.

There are no high-impact events scheduled today concerning the AUD or the USD.