AUD/USD Signal Update

Yesterday’s signal was not triggered as although the price did reach 0.7821, it kept rising without reversing.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

Long entry following some bullish price action on the H1 time frame immediately upon the next test of 0.7832.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Long entry following some bullish price action on the H1 time frame immediately upon the next test of the bullish trend line currently sitting at around 0.7818.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry following some bearish price action on the H1 time frame immediately upon the next test of the bearish trend line currently sitting at around 0.7899.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

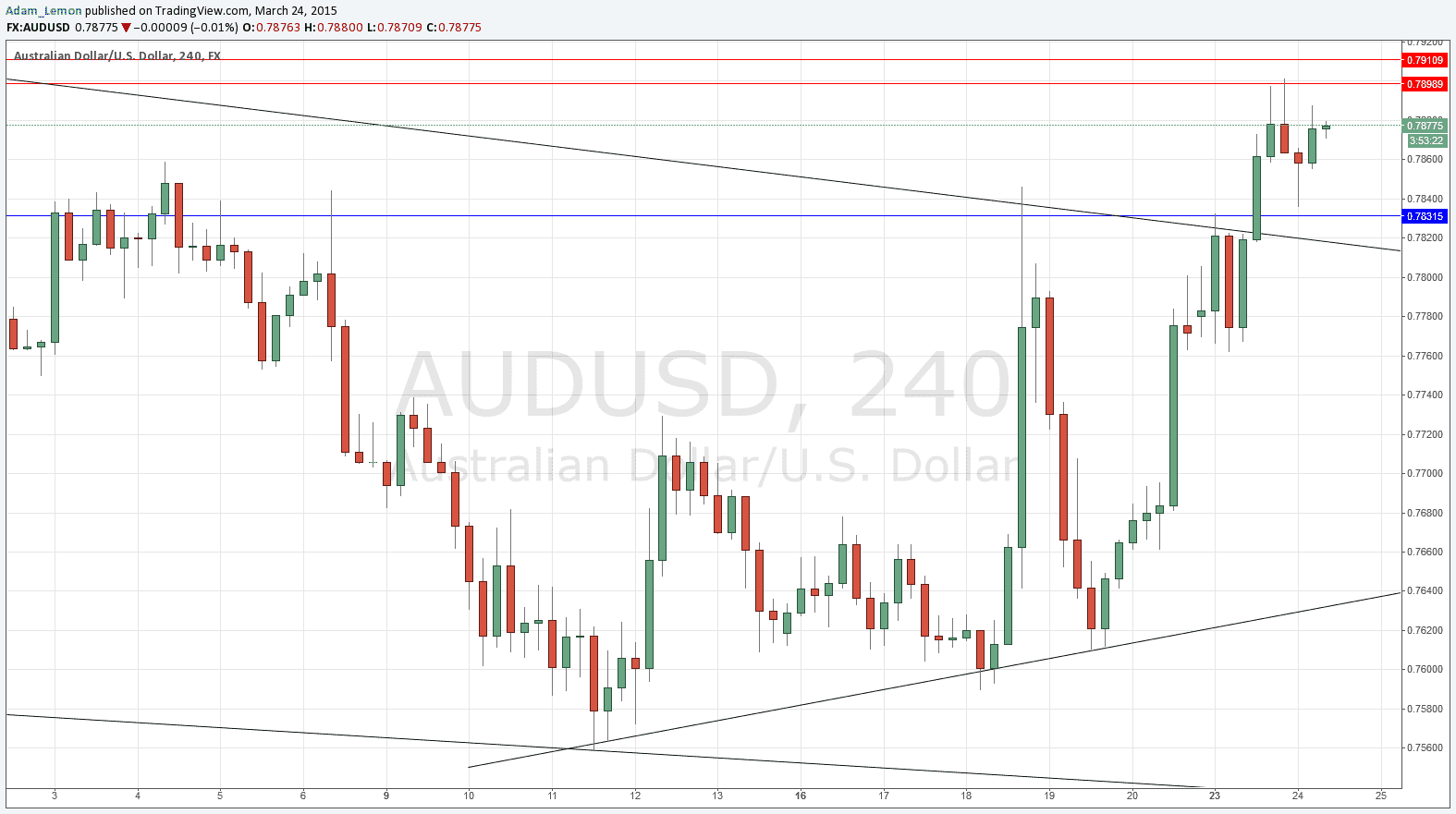

AUD/USD Analysis

The AUD, along with the NZD, has been very bullish over recent sessions. I had seen it is as probable that the triangle would contain this pair, but instead there was a bullish breakout from the triangle, beyond the recent double top, and the price proceeded overnight all the way to the next whole number at 0.7900, from which it has been falling. I had identified that area as likely to be resistant but saw it as too far away to be concerned with yesterday.

Right now things still look bullish, but the price may well consolidate now and remain trapped between the likely flipped resistance to support and the broken trend line shown below the current price in the chart here, and the resistance above that begins at around 0.7900. There is probably more potential for a good long trade in right now.

There are high-impact events scheduled today concerning the USD but nothing regarding the AUD. At 12:30pm London time there will be a release of U.S. CPI data followed at 2pm by New Homes Sales data.