AUD/USD Signal Update

Last Tuesday’s signals expired without being triggered.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

Go long following some bullish price action on the H1 time frame immediately upon the next test of the bullish trend line currently sitting at around 0.7662.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following some bullish price action on the H1 time frame immediately upon the next test of the bearish trend line currently sitting at around 0.7796.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

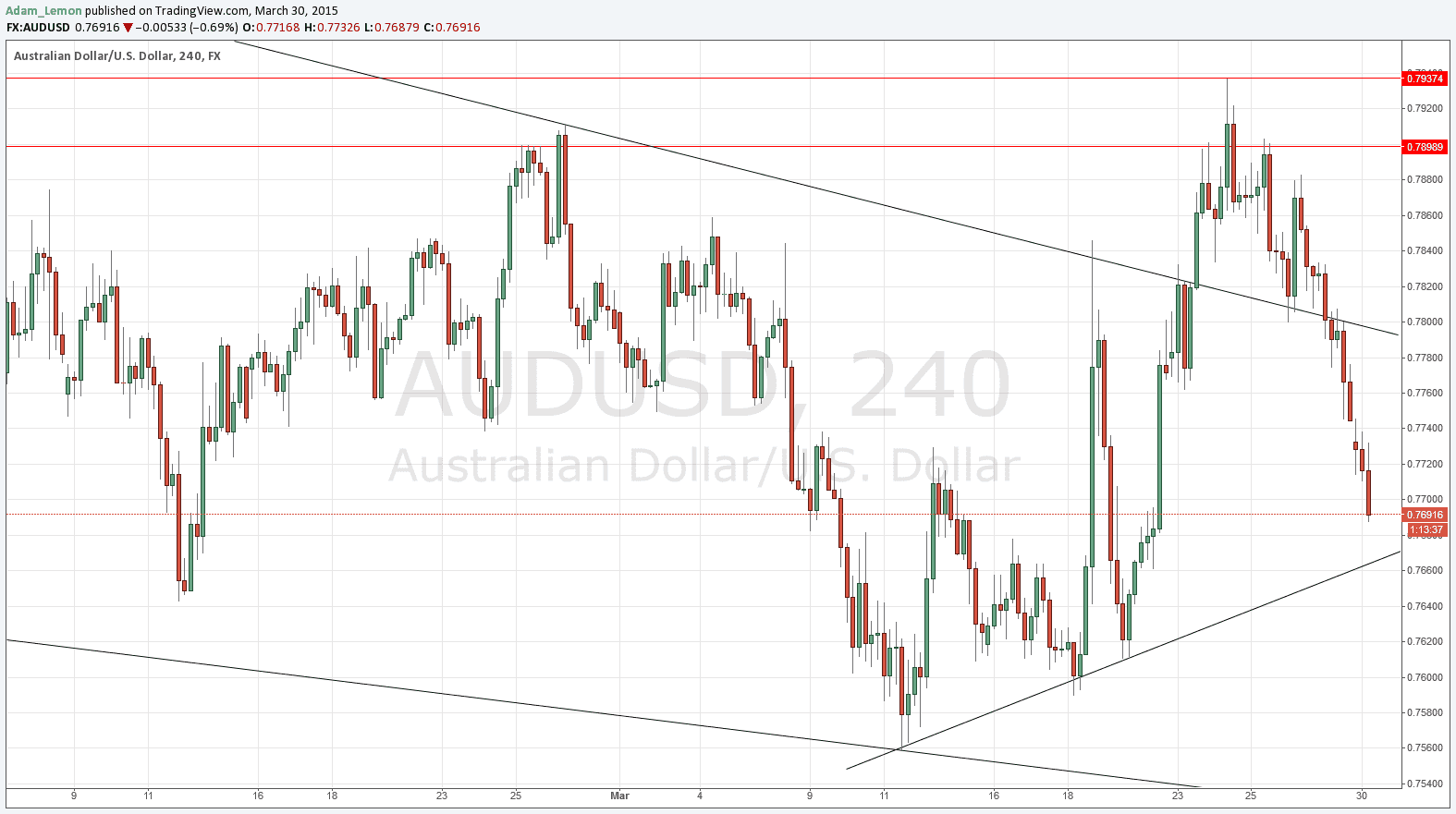

This pair was looking extremely bullish last Thursday morning, before it turned sharply with the recovery of the USD following the unsuccessful test of the resistance zone I had identified at around 0.7800. The AUD has been the major victim of the USD over the previous few days, and at the time of writing this pair continues to fall like a stone.

We are now approaching some possible support, with the short-term bullish trend line at around 0.7662, and some levels below that from which the price previously launched quite sharply. Therefore we are probably close to the end of this bearish leg.

Although the upper triangle trend line was violated, it seems to have become valid again, launching a move down after a retest from below, so a pull back to that line could be a nice location at which to look for a short trade.

There are no high-impact events scheduled today concerning either the AUD or the USD.