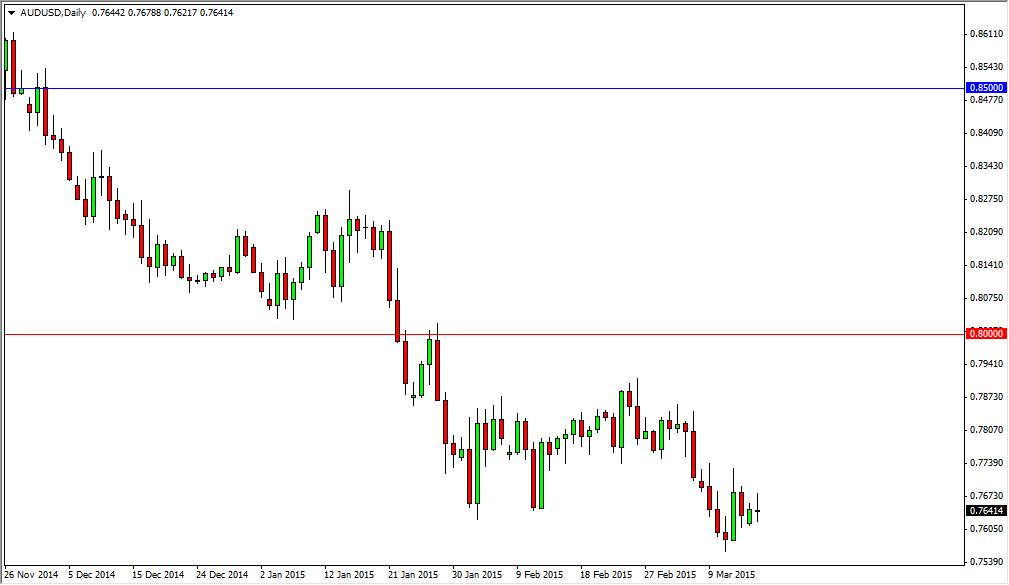

The AUD/USD pair tried to rally during the course of the session on Monday, but found the 0.77 level to be a bit too resistive. With that, we ended up turning back around and forming a shooting star. With that being the case, the market looks like it’s ready to continue to go lower. Because of this, I feel that the market will head back down to the 0.75 level. I believe that the market will eventually break down below there as well, but ultimately I feel that it might be a bit of a struggle between here and there. It will be volatile, but that doesn’t mean that the downtrend won’t continue. In fact, the commodity markets are very soft rain now, and that of course is very negative for the Australian dollar.

Any rally at this point time looks very suspicious to me, and that offers a nice selling opportunity in my opinion. I believe that the market has massive amounts of resistance all the way to the 0.80 handle, so really at this point in time I am looking for resistive candles to continue to sell and take advantage of what could be value in the US dollar.

Selling rallies, buying value

If the market rallies, I am buying value in the US dollar. After all, the market should favor a stronger US dollar over the longer term as well, and with that I think that there is really no way to get long of this market for any real length of time so it’s easier to simply step back and look at those as trading opportunities instead of trying to pick up a few pips here and there the long side. Remember that the gold markets look a bit soft, so it’s almost impossible to imagine that the Australian dollar will continue to strengthen anytime soon, so having said that I am very negative of this pair although I recognize that the freefall that we had seen before will more than likely not be replicated anytime soon.