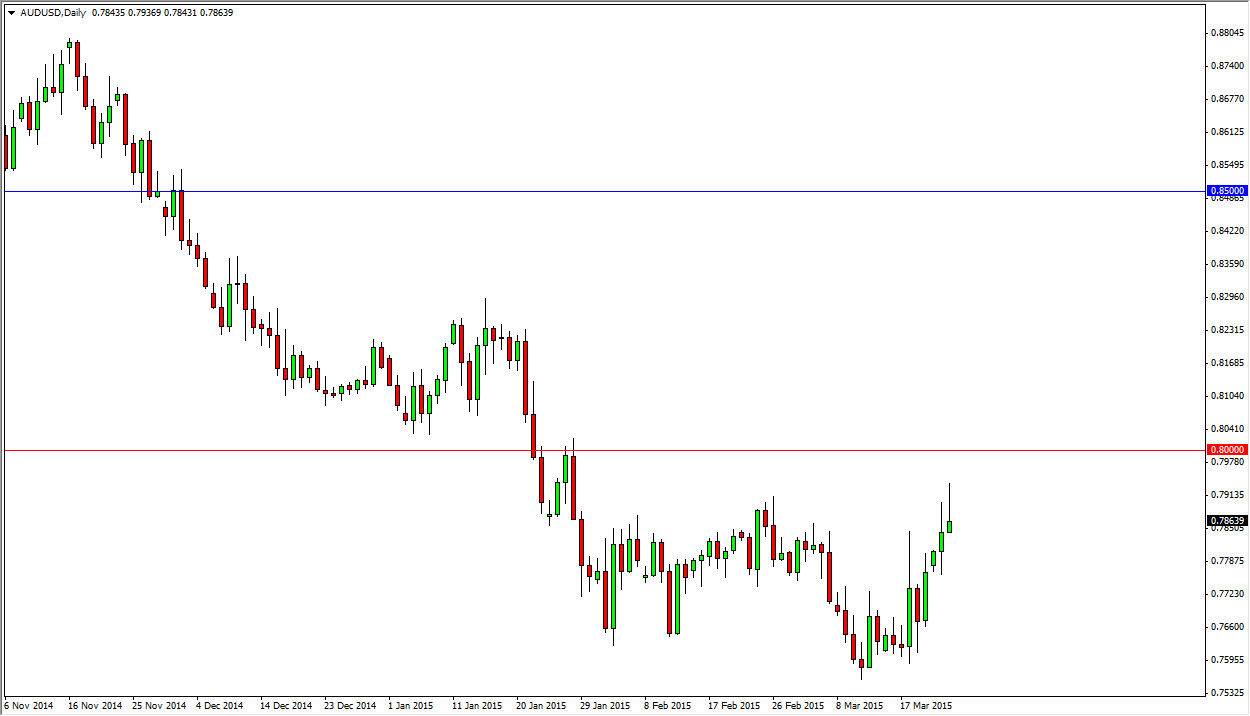

The AUD/USD pair initially tried to rally during the course of the session on Tuesday, but found the 0.79 level to be a bit too resistive and therefore pulled back to form a nice-looking shooting star. The shooting star is absolutely perfect in its shape, and its location. After all, the 0.79 level is the beginning of a significant amount of resistance as far as I can see, heading to the 0.80 level. I think that it’s only a matter of time before we break back down, and as I look at this chart I can think that a break below the bottom of the shooting star would in fact be a nice selling opportunity. I think at that point in time the market should eventually head down to the 0.76 level, and then perhaps even lower than that as the bearish pressure on both commodities and the Australian dollar continues to increase.

This is about the US dollar…

The US dollar is without a doubt the most important currency in the world right now as it is favored by almost everybody else. I believe that the market will continue to favor the US dollar in general, as the commodity markets are so soft, and the global growth scenario doesn’t necessarily favor commodity-based currencies such as the Australian dollar either. Remember, Australia supplies Asia with most of its raw materials, and that of course means that it needs a nice strong global economy in order to benefit from its commodity exports, which of course is a majority of the Australian economy.

I also recognize that the 0.80 level above is a massively important level on the chart from a longer-term perspective as well, and as a result I feel the fact that we have broken down below there is a sign of longer-term weakness. I think that rallies will continue to be sold, and therefore I think short-term traders will help us push the Australian dollar much lower given enough time. In fact, I have no interest in buying this pair until we get above the 0.82 level when it would have proven itself to me.