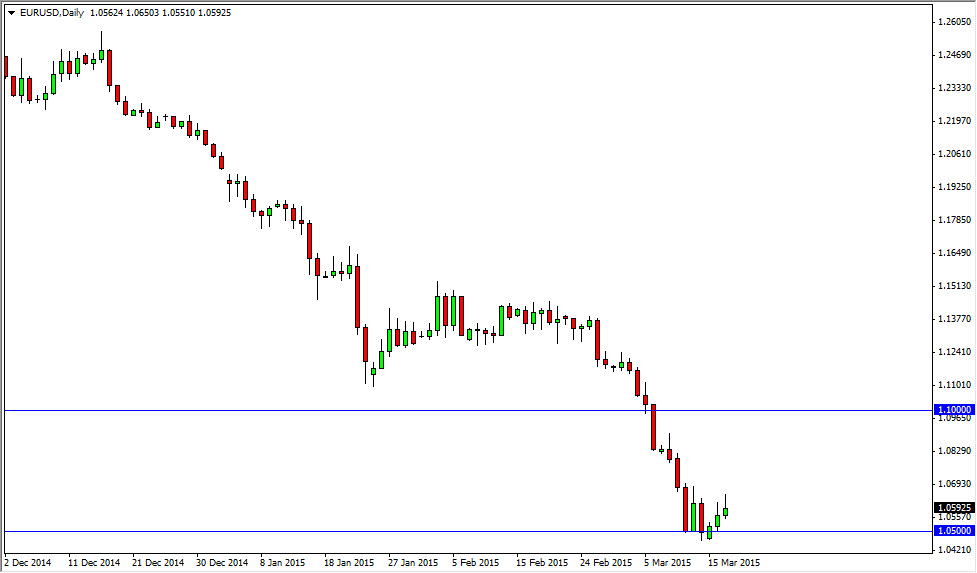

The EUR/USD pair tried to break out to the upside during the course of the session on Tuesday, but struggled at the 1.06 level. By doing so, we ended up forming a shooting star, and tells us that the market more than likely would break down. I believe that this market is one that can be sold again and again, but the 1.05 level below of course is going to cause a little bit of support. Ultimately, if we can break down below there on a daily close, I feel that we would then have the wherewithal to break down to the parity level. Any rally at this point time might look like a sign of strength, but quite frankly I feel that there is massive resistance all the way to the 1.10 handle. With that, I have absolutely no interest in buying this market as there so much in the way of resistance anyway.

The European Central Bank

The European Central Bank will have to keep a very loose monetary policy overall, and as a result I believe that the Euro will continue to see significant selling pressure. Nonetheless, I do think that the parity level below of course will offer a significant amount of support because it’s so massive in its implications, and the 1.0000 level is about as “big and round” as you can possibly get.

If you rally from here, you have to look at the 1.10 level as the absolute “ceiling” in this market place, and that there would be quite a bit of selling pressure in that area. After all, it used to be massive support, so that of course means that it should be resistance. The trend is most obviously down, and there’s no signs of that changing anytime soon. Ultimately, the market should continue to see rallies as potential value in the US dollar, which of course is one of the easiest ways to see a market go in one direction. Ultimately, I think you cannot buy this pair under any circumstances.