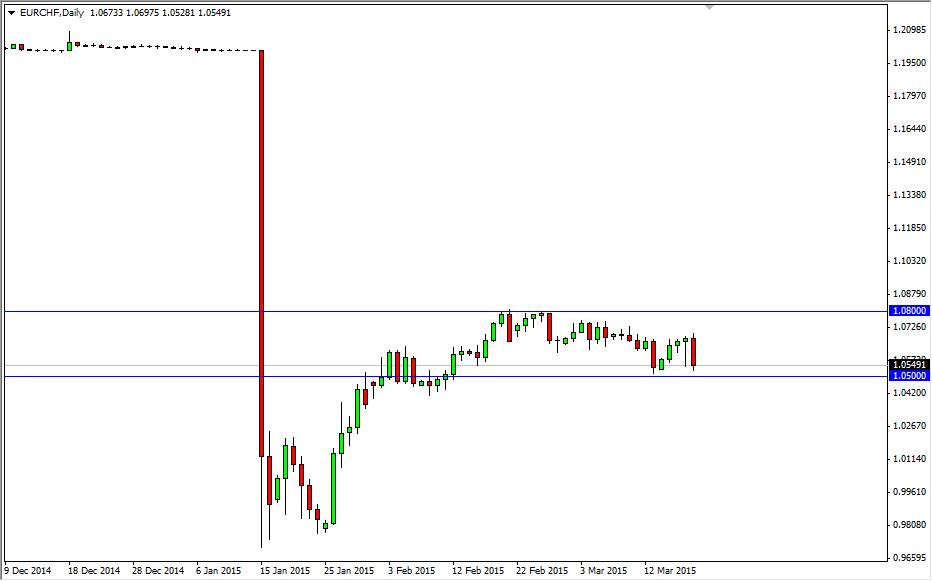

The EUR/CHF pair is in exactly exciting to trade these days, as last couple of weeks have been fairly quiet. However, one of the things that I like the most about this pair is that it tends to be fairly reliable. We have clearly carved out a consolidation area between the 1.05 level on the bottom, and the 1.08 level on the top. Ultimately, I do think we break out of this range but in the meantime it does look like the market is going to respect the two levels. With that being said, I believe that we may see a potential buying opportunity.

I would look towards the short-term charts for supportive candles, and I believe that the support at the 1.05 level isn’t actually broken into we get below the 1.0450 handle. With that, I think that any type of supportive candle can be used to pick up short-term value, but ultimately I believe that the market does break down given enough time. So with that being said, I believe that your position size probably is going to have to be a little bit smaller if you’re going long.

Breakdown

On the other hand, if we break down below the aforementioned 1.0450 handle, I believe that the market then goes back down to the parity level fairly quickly. After all, the Euro is struggling overall, and although the Swiss National Bank abandoned the currency peg, the truth of the matter is that anybody who had been long of this market beyond the Swiss National Bank is probably out of the equation now. I believe that we could break down but it will be the precipitous fall that you so earlier obviously. Ultimately, I am much more comfortable selling resistive candles above, especially near the 1.08 handle, and the breakdowns below the 1.0450 level. In the meantime, I will simply place small trades back and forth in order to pick up a little bit of profit here and there to add to my account and the other trades.