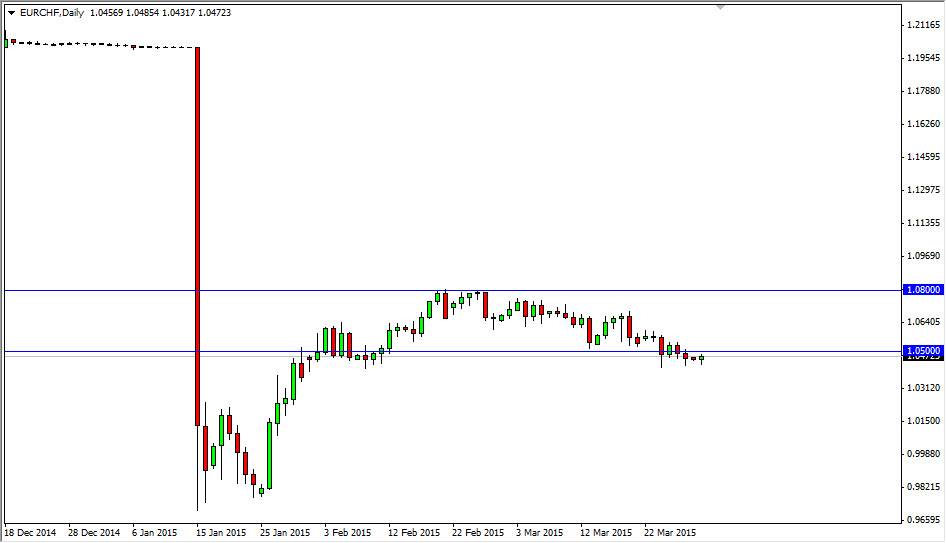

The EUR/CHF pair went back and forth during the course of the session on Monday, essentially settling nothing. However, I do recognize of the 1.0450 level below is a bit supportive, and as a result it would not surprise me at all to see this market bounce a little bit. I think that any rally is going to be a selling opportunity though, because the downtrend is so firmly ensconced. Yes, I recognize that the Swiss National Bank isn’t happy about this, but quite frankly they don’t have a choice as the market essentially collapsed on them as soon as they made the announcement they were no longer pegging this currency pair at 1.20 in the future.

A break down below the 1.0450 level since this market looking for parity, and then perhaps the 0.98 handle. Down there is a significant amount of support, but quite frankly I think it has to be tested yet again. It’s only a matter of time before we break down, so I have absolutely no interest in buying this pair.

[CAD:FXAcademy CTA #73]Selling rallies

I believe that every time this pair rallies for any significant amount, you could probably start selling. I think that the pair will continue to be very calm, as the Swiss National Bank is probably facilitating a “slow exit” from higher currency valuations. Ultimately, I do think that the Swiss have no choice but to capitulate, and quite frankly it’s been kind of surprising that it lasted for four years. Ultimately, this pair probably goes below the recent low but it’s going to be very slow-moving. Do not expect erratic movement, and quite frankly I think that there’s a bit of a ceiling in this market at the 1.08 handle. There will be no buying of this pair as far as I’m concerned, at least not until the EUR/USD pair search to look a little bit healthier, which is a long way away at this point.