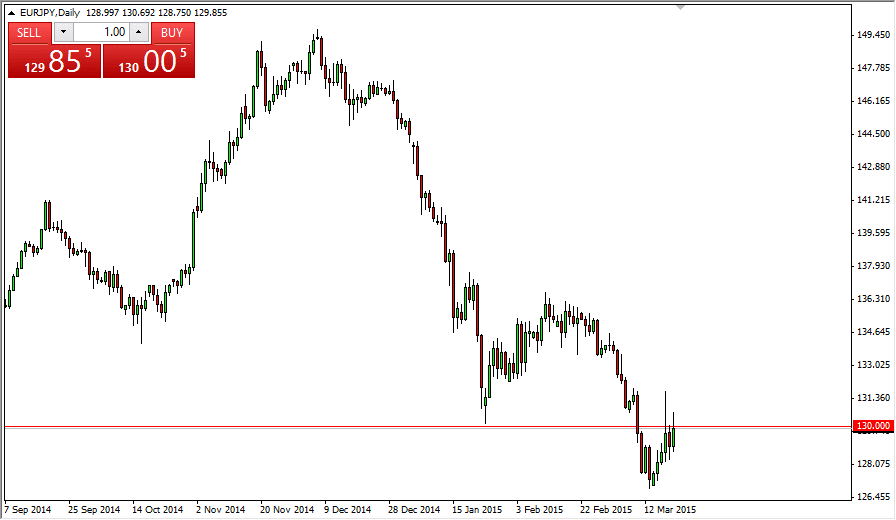

The EUR/JPY pair rallied during the session on Friday, but as you can see from above the 130 level. This is an area that of course has been supportive and resistive in the past, so it’s not that big surprise. I believe that the market will continue to go lower based upon the fact that we form such a perfect shooting star, and this is not the first time the 130 level has turned the market away. With this, I believe that we are heading down to the 125 handle given enough time, but it might be a little bit of a choppy affair.

I have to admit, I don’t necessarily like buying Japanese yen, but I think against the Euro it’s a little bit different story than we may see in other currencies. After all, Euro suffers from being the most hated currency in the markets right now, and with that I believe that it’s only a matter of time before it continues to break down. In fact, I think you can basically trade this market based upon what’s going on in the EUR/USD pair, as it is indicative of Euro strength in general.

Parity

The most important number in this market as far as I can see is the 1.0000 level, and in the EUR/USD market. This is because if the Euro falls to the parity level against the US dollar, it will have broken through significant support yet again and would have lost a massive amount of value in the last year or so. With that, there is a certain psychological importance of the number, and as a result that would make the market very negative on the Euro yet again.

Ultimately, I think that it’s only a matter of time before the seller’s takeover, so even if we rally from here I think that it’s a nice opportunity to start selling again. I really don’t have a scenario in which I am willing to buy this pair again.