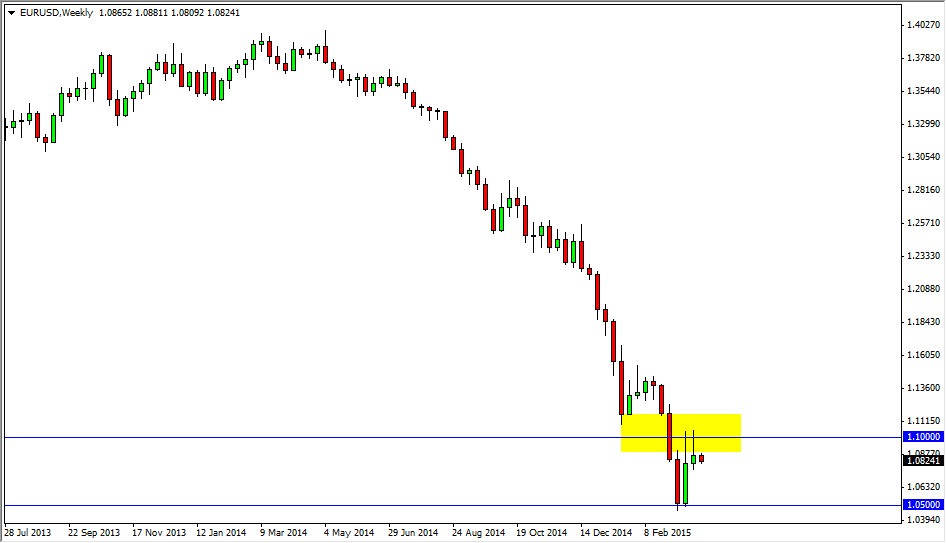

The EUR/USD pair has been rather volatile for the month of March, testing the 1.10 handle for resistance eventually, but only after testing the 1.05 level for support. With the attached weekly chart, you can see that it does look like the sellers are coming back in as we formed a shooting star at the 1.10 level, and quite frankly this leads me to believe that this pair will head back down to the 1.05 handle. I think we break below there given enough time, but it might take a little bit of sideways action first in order to build up that type of momentum.

If we can get below the 1.05 handle, that should open the way to the parity level. That parity level should continue to be the target over the longer term, and that every time the market rallies we will more than likely have selling pressure. I have no interest whatsoever in buying this pair until we get above the 1.15 handle, something that I do not anticipate seeing anytime soon. In fact, I believe that the entire careers could be made of shorting the Euro for short-term trades here over the next several weeks.

[CAD:FXAcademy CTA #121]Just sell the rallies

I believe that the easiest way to trade this pair is to simply sell the rallies. There’s no need to get bullish of the Euro right now, and quite frankly I think that the European Central Bank will get looser as time goes on. That of course will work against the value the Euro, and as a result it’s likely that this pair breaks down. If we did break above the 1.15 handle, I would of course have to reevaluate the entire situation but I really don’t see that happening. In fact, if it did I would be surprised and at this point time would be very concerned about the currency markets in general as that would show such a massive shift in momentum.