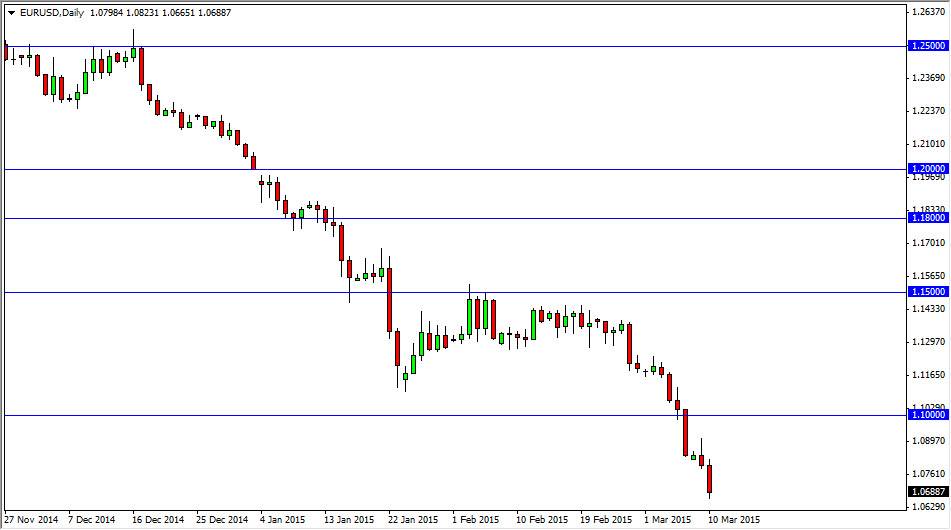

The EUR/USD pair initially tried to rally during the session on Tuesday, but only gained a few pips before turning back around and falling off of a cliff. Because of this, the market looks like it’s ready to go down to the 1.05 level, which of course is the next large, round, psychologically significant number. On top of that, the fact that we had formed a shooting star on Monday, tells me that this market is simply running out of bullishness. At this moment in time, it appears that the market will simply continue to fall in favor of the US dollar, which of course is the most favored currency in the Forex world right now.

The US dollar continues to strengthen against the Euro, not only because of the fact that the Federal Reserve has step away from quantitative easing, but also the fact that the European Central Bank continues to be stuck in a situation where loose monetary policy will be needed. Ultimately, I think that this pair is going to continue to be one of these situations where you can just simply sell every time this market rallies, as it represents a bit of value in the US dollar.

The candle looks pretty bearish as well.

The candle itself looks pretty bearish as well, so to be honest with you I just don’t see an argument for buying this pair. Yes, we could bounce significantly due to the fact that we are oversold, but it’s only a matter of time before the sellers come back in. In fact, I believe that the 1.10 level above is the ceiling at the moment, and is going to be difficult to break above that level for any significant amount of time.

I do recognize that the 1.05 level below is a large, round, psychologically significant number, but I also recognize that on the longer-term charts. It seems that parity is much more important, and therefore I feel that’s where we’re going to go. This will take a while to get there, but I think the writings on the wall at this point.